6 Dividend ETFs That Pay You to Stay Put in 2025

Stop Ghosting Your Portfolio, Start Dating Dividend ETFs

Tired of chasing meme stocks that tank faster than your New Year’s resolutions? Yeah, me too. If you’ve ever bought into the hype of a “can’t miss” stock only to watch it implode like a cheap lawn chair, you already know the importance of boring, consistent income.

Enter dividend ETFs — the relationship upgrade your portfolio needs. Unlike that ex who promised stability but delivered chaos, these funds actually pay you regularly for sticking around. In 2025, some dividend ETFs are quietly handing out yields north of 3–7%, with none of the drama of stock-picking.

So let’s rank the best of the bunch. Grab your coffee (or bourbon — I don’t judge), because we’re about to separate the reliable income friends from the yield catfishers.

What Makes a Dividend ETF Worth Buying in 2025?

Before we throw tickers at you like darts in a bar, let’s talk criteria. Not every dividend ETF deserves a seat at your portfolio’s table — some are solid, others are the financial equivalent of gas station sushi. Here’s how to separate the paycheck machines from the yield traps:

✦ Low Expense Ratio

Nobody likes paying management fees higher than their Wi-Fi bill. Expense ratios matter because they’re a guaranteed cost — whether the market goes up, down, or sideways. A 0.50% fee may not sound like much, but over decades it quietly eats away at your returns like financial termites.

In 2025, you don’t need to overpay — Vanguard, Schwab, and iShares offer high-quality dividend ETFs for 0.06%–0.08%, basically pocket change. Anything creeping above 0.40% needs to prove it’s adding serious value (active management, covered-call income, etc.).

👉 Translation: Go cheap unless the strategy truly earns its keep.

✦ Dividend Yield

This is why you’re here — the payouts. But bigger isn’t always better. The sweet spot for ETFs is usually 3–6%: enough income to matter, not so high that it screams “we’re desperate.”

Once you see yields pushing 8%+, you’re usually looking at funds stuffed with struggling companies, REITs on life support, or exotic option strategies that limit upside. High yield today often means heartbreak tomorrow.

👉 Translation: Aim for a yield that pays the bills without sending your blood pressure through the roof.

✦ Quality Holdings

The ETF’s guts matter more than the ticker symbol. The best dividend ETFs load up on blue chips, dividend aristocrats, and cash cows that have weathered recessions, inflation, and CEO scandals without cutting payouts.

Think Pepsi, Johnson & Johnson, Microsoft — not your cousin’s SPAC or that crypto miner with a balance sheet thinner than a cocktail napkin. Always check the top 10 holdings before buying. If half the list makes you squint, it’s probably not the fund for you.

👉 Translation: If you wouldn’t trust the companies inside to babysit your money, don’t trust the ETF either.

✦ Dividend Growth Track Record

It’s not just about the yield today — it’s about what that yield looks like 10 years from now. A fund that invests in companies raising dividends year after year gives you a built-in inflation hedge.

This is why ETFs like SCHD and DGRO are investor favorites — they reward patience with steadily increasing payouts. Stagnant dividends, on the other hand, are like your unused gym membership: technically there, but not doing you any favors.

👉 Translation: Buy funds that treat dividends like rent — always due, and always going up.

The 6 Best Dividend ETFs for 2025 (Deep Dive)

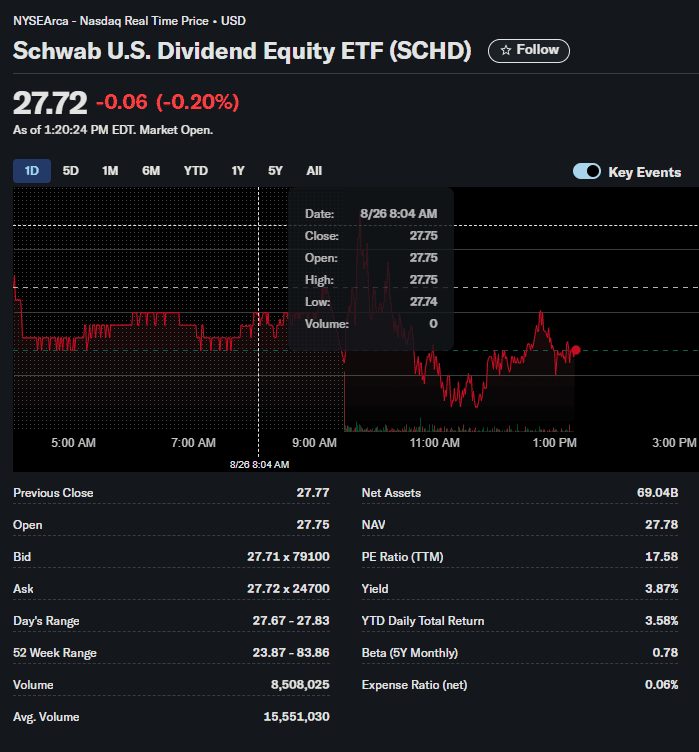

1. SCHD – Schwab U.S. Dividend Equity ETF

- Yield: ~3.6%

- Expense Ratio: 0.06%

- Top Holdings (2025): Broadcom, PepsiCo, Home Depot, Texas Instruments, Coca-Cola

- Sector Tilt: Industrials, financials, consumer staples

SCHD is the gold standard for dividend investors right now. Its methodology screens for quality dividend payers with strong balance sheets, high free cash flow, and at least 10 years of dividend history. That means you avoid shaky companies dangling unsustainable yields.

Why investors love it: SCHD has crushed other dividend ETFs in total return over the last decade, thanks to both yield and price appreciation. It’s not just an income play — it grows.

Best for: Investors who want a set-it-and-forget-it core holding with dependable income and capital appreciation.

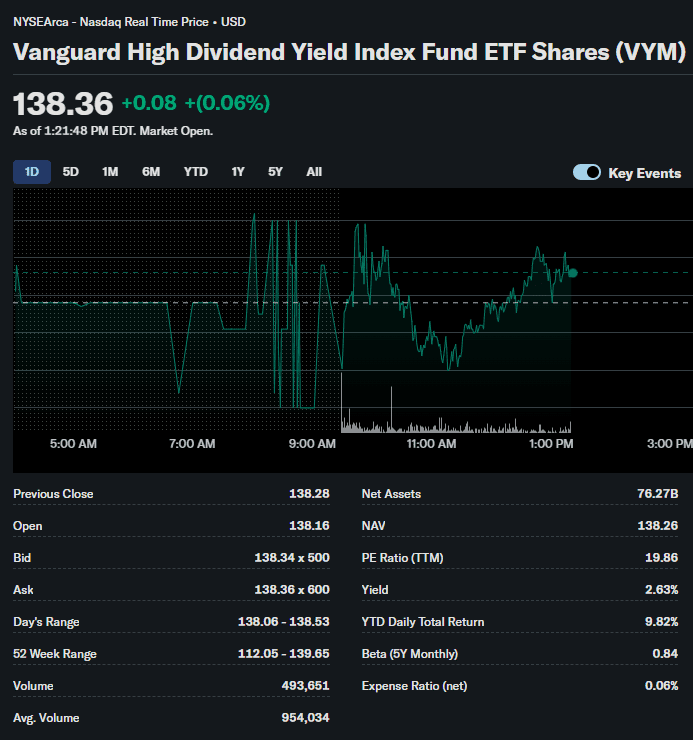

2. VYM – Vanguard High Dividend Yield ETF

- Yield: ~3.1%

- Expense Ratio: 0.06%

- Top Holdings: Johnson & Johnson, JPMorgan Chase, ExxonMobil, Procter & Gamble, Pfizer

- Sector Tilt: Heavy on financials and healthcare, plus energy exposure

VYM is the workhorse ETF in this space. With over 400 stocks, it spreads your risk like peanut butter on toast. You’re not relying on just a few companies to keep paying dividends — you’re diversified across sectors.

Why investors love it: The yield isn’t sky-high, but it’s sustainable. VYM holds a ton of dividend stalwarts (think J&J and JPMorgan), so your checks are steady.

Best for: Income investors who want broad coverage of high-yield stocks and can sleep soundly knowing they’re diversified to the hilt.

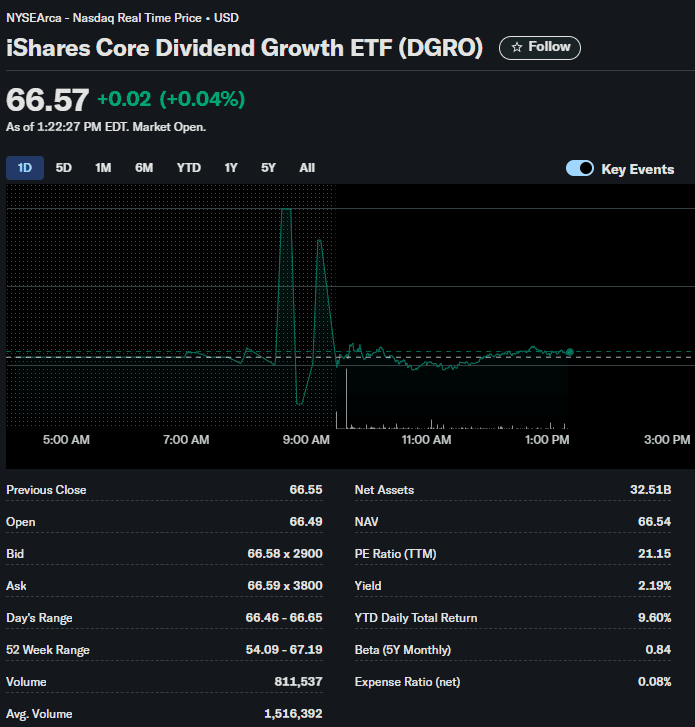

3. DGRO – iShares Core Dividend Growth ETF

- Yield: ~2.6%

- Expense Ratio: 0.08%

- Top Holdings: Microsoft, Apple, JPMorgan Chase, Johnson & Johnson, Home Depot

- Sector Tilt: Tech, healthcare, financials

DGRO takes a different approach: it focuses on dividend growth, not just high yields. To make the cut, a company must have five consecutive years of dividend hikes and the earnings to support it. That rules out shaky firms and yield traps.

Why investors love it: DGRO is lighter on current yield but shines in long-term compounding. Think of it as planting dividend seeds today that grow into oak trees over decades.

Best for: Younger investors or long-term builders who want dividends that rise every year, not just payouts today.

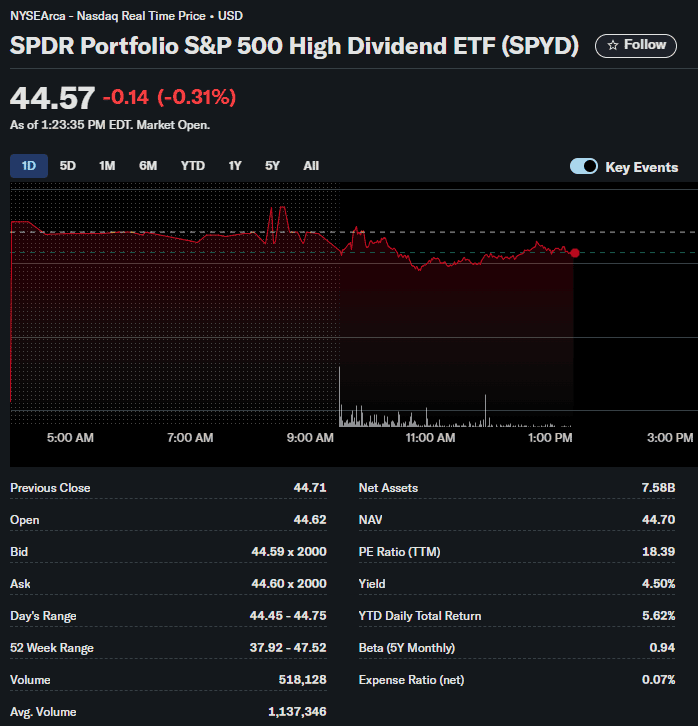

4. SPYD – SPDR Portfolio S&P 500 High Dividend ETF

- Yield: ~4.9%

- Expense Ratio: 0.07%

- Top Holdings: Rotates quarterly — but think utilities, REITs, energy, and financials

- Sector Tilt: More cyclical sectors, heavy real estate & utilities

SPYD screens for the 80 highest-yielding stocks in the S&P 500 and weights them equally. That means it doesn’t overweight mega-caps like Apple or Microsoft. The result: higher income, higher volatility.

Why investors love it: That near-5% yield is tempting, and equal weighting makes it unique compared to other dividend ETFs. But because it leans on cyclical sectors, it can swing harder in downturns.

Best for: Yield chasers who want higher income now and can handle some rollercoaster action.

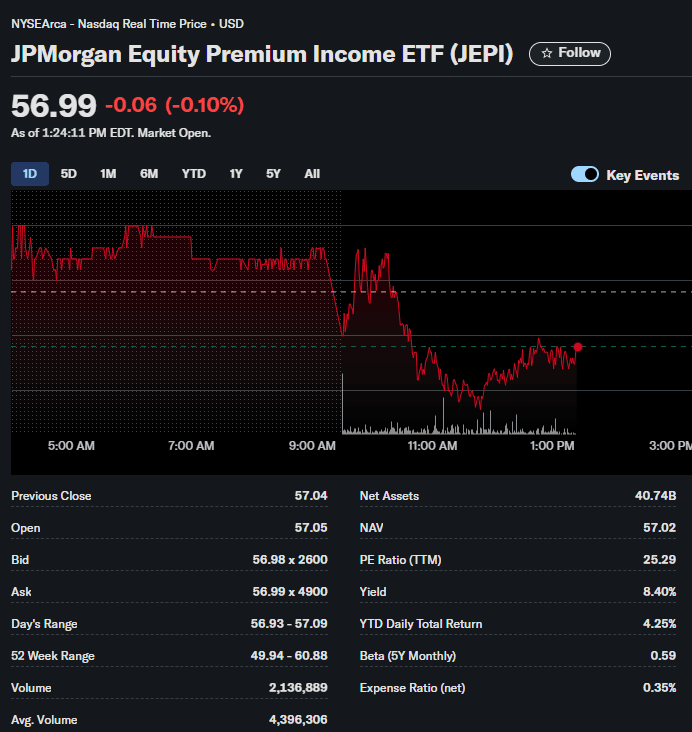

5. JEPI – JPMorgan Equity Premium Income ETF

- Yield: ~7–9% (monthly)

- Expense Ratio: 0.35%

- Top Holdings: Microsoft, UnitedHealth, AbbVie, Coca-Cola, and equity-linked notes

- Strategy: Covered call writing on large-cap stocks

JEPI is the new income superstar. By selling covered calls, it generates hefty monthly payouts — often 7%+. But the trade-off is limited upside during raging bull markets. You’re capping growth to fund that income.

Why investors love it: Predictable monthly checks. If you’re living off dividends or want cash flow, JEPI feels like a second paycheck.

Best for: Retirees or income-focused investors who want high, steady income and don’t care about maximizing growth.

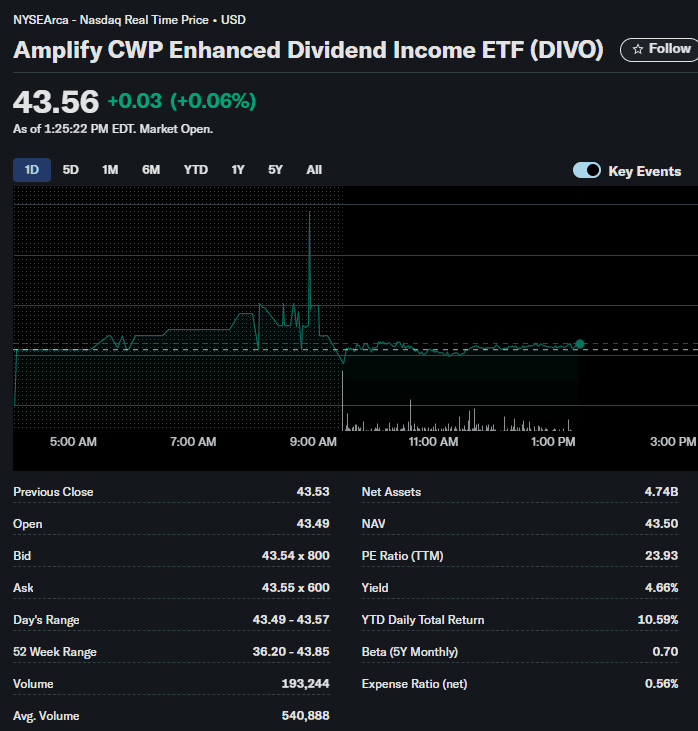

6. DIVO – Amplify CWP Enhanced Dividend Income ETF

- Yield: ~4.6% (monthly)

- Expense Ratio: 0.55%

- Top Holdings: Microsoft, Johnson & Johnson, Visa, McDonald’s, Chevron

- Strategy: Actively managed + covered calls

DIVO is like JEPI’s more selective sibling. Instead of broad market coverage, it focuses on 25–30 blue-chip dividend growers and selectively writes covered calls. That means better stock picking (and potentially better long-term returns), but at a higher fee.

Why investors love it: A sweet spot between growth and income. You still get dividend aristocrats, plus an income boost from options.

Best for: Investors who want quality over quantity, and don’t mind paying up for active management.

Quick Comparison Table

| ETF | Yield (approx) | Expense Ratio | Holdings | Payout Frequency | Personality |

|---|---|---|---|---|---|

| SCHD | 3.6% | 0.06% | 100+ | Quarterly | Reliable golden retriever |

| VYM | 3.1% | 0.06% | 400+ | Quarterly | Steady paycheck |

| DGRO | 2.6% | 0.08% | 400+ | Quarterly | Growth student |

| SPYD | 4.9% | 0.07% | 80 | Quarterly | Wild card |

| JEPI | 7–9% | 0.35% | 100+ | Monthly | High-maintenance date |

| DIVO | 4.6% | 0.55% | 25–30 | Monthly | Boutique choice |

Key Considerations Before Buying

- Taxes: Dividends are taxable. Uncle Sam always gets his cut.

- Yield Traps: A double-digit yield looks sexy until the ETF slashes it. Don’t get catfished.

- Diversification: Don’t put everything in one ETF basket — mix yield, growth, and sectors.

- Time Horizon: JEPI and DIVO are great for income now; SCHD and DGRO shine over decades.

Dividend ETF FAQs (2025 Edition)

Are dividend ETFs better than dividend stocks?

Depends on your personality. If you like control and bragging about owning Coca-Cola since 1998, go with stocks. If you’d rather automate and chill, dividend ETFs give you instant diversification, professional management, and fewer nights stressing about earnings reports. Think of ETFs as the crockpot version of dividend investing — set it, forget it, still get fed.

What is a good dividend yield for an ETF?

The sweet spot is usually 3–6%. That’s high enough to matter but low enough to be sustainable. Anything over 8% is like someone offering you a free yacht — sounds amazing until you realize it’s sinking and comes with $50K in annual repairs.

Do dividend ETFs pay monthly or quarterly?

Most pay quarterly, but a few (like JEPI and DIVO) drop cash monthly — great if you like a steady “paycheck” feel. Just remember: monthly income doesn’t magically mean more money; it just arrives in smaller, more frequent chunks.

Can dividend ETFs lose money?

Oh, absolutely. The dividends keep rolling, but the share price can still swing with the market. 2020 and 2022 reminded investors that “income” doesn’t mean “invincible.” That’s why you diversify and avoid chasing yield like it’s free beer night.

Are dividend ETFs good for retirement?

Yes — they can be excellent for retirement portfolios because they provide cash flow, lower volatility than individual stocks, and broad diversification. Just match the ETF to your needs: SCHD/DGRO for growth, VYM for steady exposure, JEPI/DIVO for higher immediate income.

Can I live off dividend ETFs?

In theory, yes. In practice, you’d need a sizeable portfolio. A 4% yield means you’ll need about $1 million invested to generate $40K a year. That’s the cold math. Dividend ETFs can cover expenses, but they’re not a magic ATM.

Wrapping Up (and My Two Cents)

Dividend ETFs are the “low drama, high commitment” relationship your portfolio needs. SCHD is your safe bet, VYM your core companion, DGRO your long-term planner, SPYD your risky fling, and JEPI/DIVO the income machines.

Here’s my take:

- Want one fund to rule them all? SCHD.

- Want income right now? JEPI or DIVO.

- Want long-term growth with stability? DGRO or VYM.

Bottom line: Don’t just chase yield — chase consistency. Your future self (and your sleep schedule) will thank you.

👉 Next read: 5 Dividend Stocks for 2025 That Won’t Ghost You