5 Dividend Stocks That Pay You While You Sleep (Unlike Your Ex Who Just Drained You)

Remember when your ex said they’d “always be there for you”? Yeah, so do I—right before they drained your bank account and vanished faster than a meme stock after earnings. Thankfully, dividend stocks are nothing like your ex. These beauties pay you just for owning them—no texts at 2 a.m., no ghosting, just cold, hard cash hitting your account every quarter.

If you’ve read my post, I Lost $2,742 in 3 Months: My Dumbest Investing Mistake and What It Taught Me, you already know I’ve learned the hard way that chasing hype stocks is like dating someone with commitment issues. Dividend stocks? They’re the complete opposite—steady, reliable, and they don’t ghost you when things get tough.

If you’re new to dividend investing, let me break it down in the least boring way possible:

A dividend stock is a share of a company that pays out part of its profits to shareholders. Think of it as a thank-you note—except instead of empty words, you get actual money (or at least enough to buy that overpriced latte you swear you’re giving up).

In this post, we’ll cover 5 dividend stocks worth your attention right now—complete with yields, reasons they’re sexy (financially speaking), and a dose of sarcasm to keep you awake.

Why Dividend Stocks Are Your Best Friend (and Not in a Toxic Way)

Unlike speculative growth stocks that promise to make you rich “someday” (while currently burning cash like a college kid with a credit card), dividend stocks pay you now. It’s like the difference between dating someone who “might” propose in 5 years and dating someone who brings you tacos every Friday—one’s a dream, the other’s dependable.

Key Benefits of Dividend Stocks:

- Passive Income: Your money works while you binge Netflix.

- Stability: Dividend payers tend to be mature, stable companies that don’t implode at the first sign of a recession.

- Compounding: Reinvest dividends, and you’re basically snowballing your way to financial freedom.

- Flexibility: Want cash flow during retirement? Dividend stocks got your back.

If you want to nerd out on dividend strategy, check out Investopedia’s Guide to Dividends for a deeper dive.

5 Dividend Stocks That Don’t Flake on You

These are not your typical “get rich quick” picks. These companies have actual cash flow, real businesses, and a track record of paying investors like clockwork. Oh, and they don’t post inspirational quotes on Instagram after a breakup.

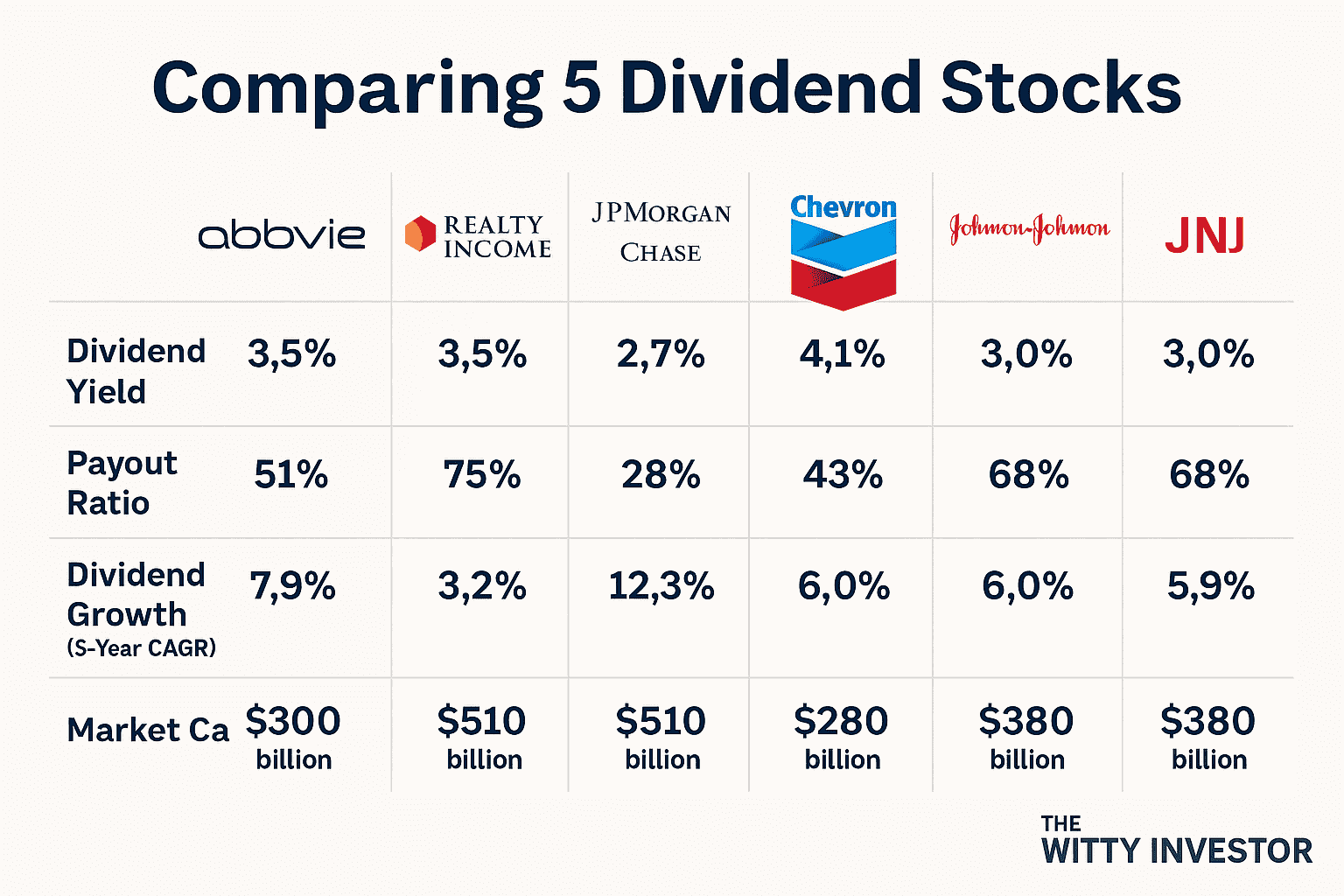

1. AbbVie (ABBV)

- Dividend Yield: ~3.5%

- Why I Like It: AbbVie is the pharmaceutical giant behind Humira and Botox, meaning they profit every time someone wants fewer wrinkles or needs serious medicine. It’s basically recession-proof—because people will always pay to look good and stay healthy.

- Witty Take: Owning ABBV is like dating a dermatologist—smooth, reliable, and it keeps paying for itself.

AbbVie is also a Dividend Aristocrat, meaning it’s raised its dividend for over 25 consecutive years. Your ex? They probably couldn’t commit to a Netflix password.

2. Realty Income (O)

- Dividend Yield: ~5.5%

- Why I Like It: Known as “The Monthly Dividend Company,” Realty Income pays dividends every single month—like rent, but in reverse. Their portfolio includes commercial real estate for big brands like Walgreens and 7-Eleven.

- Witty Take: If O were a person, it’d be that dependable roommate who never misses rent day.

If you’re into real estate investing without fixing toilets, this REIT (Real Estate Investment Trust) is as close as you’ll get.

3. JPMorgan Chase (JPM)

- Dividend Yield: ~2.7%

- Why I Like It: It’s the largest bank in the U.S. and has survived more financial crises than Elon Musk has started Twitter (I mean, X) controversies.

- Witty Take: JPMorgan is like that reliable friend who always picks up the check—and somehow still gets richer.

Banks are benefiting from higher interest rates, meaning JPM’s profits (and your dividends) are sitting pretty.

4. Chevron (CVX)

- Dividend Yield: ~4.1%

- Why I Like It: Energy companies may not be sexy, but they sure know how to pay up. Chevron is a dividend king, and its payouts are as consistent as the rising price of gas before a holiday weekend.

- Witty Take: Think of CVX as your sugar daddy stock—always paying, never asking questions.

For a full breakdown, check Chevron’s Dividend History.

5. Johnson & Johnson (JNJ)

- Dividend Yield: ~3.0%

- Why I Like It: J&J is the company behind Band-Aids, Tylenol, and half the stuff in your bathroom cabinet. It’s diversified, recession-resistant, and has been paying dividends for 60 years straight.

- Witty Take: J&J is the kind of stock your grandma would approve of—safe, steady, and always there when you need it.

Honorable Mentions

If you’re feeling fancy, here are a few more worth keeping on your watchlist:

- PepsiCo (PEP): Dividend yield ~2.9%, and yes, it’s still better than Coke in every way that matters.

- Procter & Gamble (PG): Dividend yield ~2.5%, because people will always buy toothpaste.

- MPLX (MPLX): Yield ~8.7%, a high-yield energy play if you want bigger checks.

How to Pick Dividend Stocks Without Losing Your Mind

Before you start throwing cash at every stock with a yield over 5%, remember: high yield can be a trap. Some companies offer unsustainably high payouts because they’re desperate for investors. It’s like dating someone who buys you expensive gifts but can’t pay rent.

Key Metrics to Watch:

- Payout Ratio: How much of the company’s profit goes to dividends? Anything over 70-80% might be risky.

- Dividend Growth: Look for companies with a history of increasing dividends.

- Free Cash Flow: You want a company that’s not paying dividends with Monopoly money.

Why You Should Reinvest Your Dividends

Reinvesting dividends is like compounding interest on steroids. By reinvesting, you’re buying more shares, which leads to bigger payouts, which buys more shares—until one day, you’re making money in your sleep.

Pro tip: Check out the DRIP (Dividend Reinvestment Plan) options offered by your brokerage. Most are automatic and free.

Dividend Stocks vs. Your Ex

Your ex:

- Promised to pay you back for dinner (they didn’t).

- Left your Netflix account logged in on their new TV.

- Cost you money and brain cells.

Dividend stocks:

- Pay you real cash for just existing in your portfolio.

- Don’t leave cryptic texts like “We need to talk.”

- Actually make you richer over time.

I know which relationship I’d rather have.

Witty Investor’s Take

If you want passive income without playing the lottery of growth stocks, dividend investing is the way to go. It’s not flashy, but it’s consistent—and consistency is what builds wealth.

Start small. Buy a few shares of ABBV, JNJ, or O. Watch those payouts hit your account, and tell me it doesn’t feel better than a toxic relationship ever did.

Further Reading:

Want More Witty Investing Insights?

Subscribe to The Witty Investor Newsletter and get the funniest, snarkiest financial takes in your inbox—because serious money deserves a sense of humor.