AI Stock Frenzy: The New Crypto Bros — Don’t Be Their Exit Liquidity

In 2025, AI stocks have taken center stage much like cryptocurrency did a few years ago. The same group of investors who once shouted “Bitcoin fixes this” are now enthusiastically proclaiming, “AI will 100x this small-cap stock!”—often with the same over-the-top flair, aviator sunglasses indoors included. Every company suddenly boasts an “AI division,” retail investors proudly call themselves visionaries, and many portfolios resemble a chaotic ChatGPT hallucination rather than a carefully constructed investment.

The stock market has seen similar cycles of hype and speculation before, with past manias driven by new technologies and trends, making the current AI frenzy just the latest chapter in a long list of stock market booms and busts.

But here’s the cold, caffeinated truth: most investors chasing ai stock hype aren’t early adopters—they’re exit liquidity. The hype cycle is in full swing, and just like with crypto, many people investing in AI stocks won’t end up rich. Instead, they’ll end up educated—albeit at a steep price. This article isn’t about bashing artificial intelligence stocks but about separating genuine AI innovation from AI inflation, helping you invest wisely without becoming a bagholder in this digital gold rush.

Déjà Vu: We’ve Seen This Movie Before

If you remember 2021, you’ll recall the meteoric rise of cryptocurrencies. Everyone seemed to become a crypto millionaire overnight—until regulators and reality showed up, and the bubble burst. Influencers flaunted Lamborghinis and promised decentralized finance revolutions, only for many to lose their shirts when the market corrected.

Fast forward to 2025, and the buzzwords have changed, but the behavior around AI stocks hasn’t. The term “AI” is slapped on everything like a marketing band-aid. We now have AI toothbrushes, AI refrigerators, and even AI socks that claim to optimize temperature dynamically. This should sound familiar. Just as every startup in 2021 added “blockchain” to its pitch deck, today companies are inserting “AI” into earnings calls to spike their stock price.

The surge in AI stock prices mirrors the dot-com bubble more than many investors want to admit. History doesn’t repeat—it rebrands. By analyzing data and investor behavior from the past, we can draw valuable lessons to inform smarter investment decisions in today’s AI-driven market.

How AI Mania Is Inflating Stock Valuations

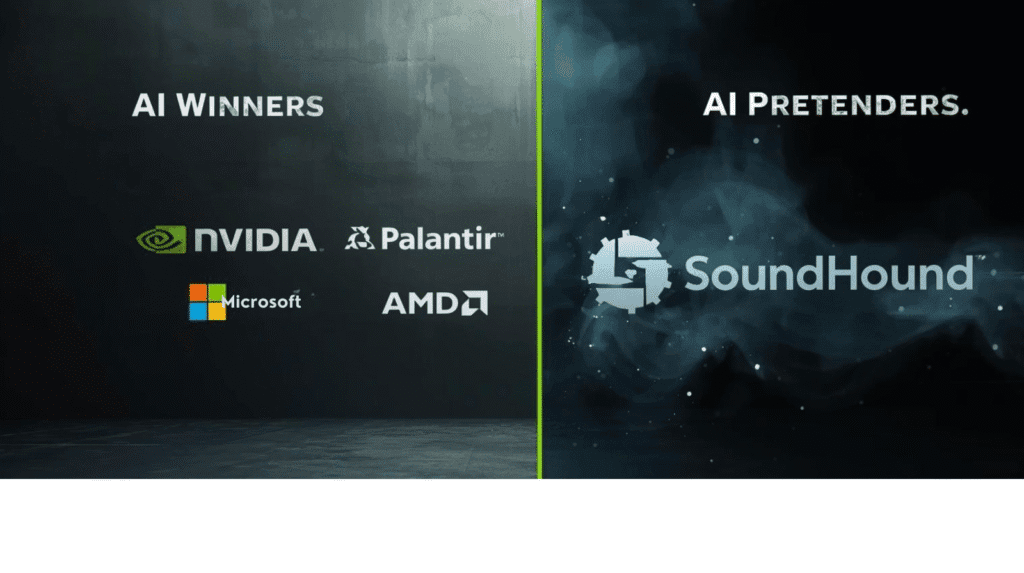

There’s no denying that artificial intelligence will reshape entire industries. However, the investing frenzy around AI stocks has detached from reality faster than a Tesla on autopilot. Consider C3 AI Inc (ticker: AI), a company headquartered in Redwood City that specializes in enterprise artificial intelligence software. Despite limited profits, the hype machine has turned it into a cult stock. Similarly, SoundHound (SOUN), a voice-AI company, has more buzz than balance sheet to back it up.

Meanwhile, giants like NVIDIA and Microsoft are generating real revenue from AI infrastructure and cloud integration. NVIDIA’s GPUs power everything from OpenAI’s models to Tesla’s autopilot, and Microsoft has embedded AI across its Office suite and Azure cloud platform. Yet, even their valuations make traditional analysts sweat through their Brooks Brothers.

Today, many AI stocks trade on hope rather than earnings. Recent AI earnings reports, highlighting figures like earnings per share (EPS), revenue, and net income, show that while some companies are demonstrating real profitability and investment potential, others still lag behind expectations. Traditional metrics like price-to-earnings ratios and free cash flow have become secondary to how often a CEO says “AI” during conference calls. If a company mentions AI more than revenue, it’s probably trying to sell shares, not software.

Red Flags That You’re the Exit Liquidity

How can you tell if you’re the sucker holding the bag on AI stocks? Here are some warning signs:

Sudden changes in leadership or unexpected shifts in financial metrics can be a major red flag, signaling potential instability or deeper issues within the company.

1. You Found the Stock on TikTok

If a shirtless 23-year-old is hyping “the next NVIDIA” while lip-syncing to Travis Scott, congratulations—you’re watching marketing, not serious analysis. Social media hype is the biggest driver of retail investors pouring money into overvalued AI stocks.

2. Buzzword Overload

Terms like “disruptive,” “transformational,” and “AI-powered synergy” are red flags rather than investment theses. Instead of hashtags, read the company’s 10-K filings on the SEC website to understand real business fundamentals.

3. Earnings ≠ Excuses

When a CEO blames a “mission critical AI integration phase” for missed revenue targets, it usually means the company spent too much on hype and marketing, hoping the AI buzz buys them time.

4. They Sell Nothing but Stock

If a company issues more shares than products, run. Many AI stocks use hype to justify secondary offerings that dilute shareholder value and destroy long-term investment returns.

5. They Have a Meme Following

If Reddit calls it “the next NVDA,” it’s probably the next Pets.com. Meme stock status rarely translates into sustainable profits.

Company Profile and Valuation of C3 AI Inc

If you’re looking for a pure play in enterprise artificial intelligence software, C3 AI Inc (NYSE: AI) is the name that keeps popping up on analysts’ radars—and for good reason. Headquartered in Redwood City but operating across multiple geographical segments, including North America, Europe, the Middle East and Africa, Asia Pacific, and the Rest of World, C3 AI Inc delivers a robust suite of AI applications designed to help organizations deploy, manage, and scale mission critical AI.

C3 AI Inc’s portfolio isn’t just a buzzword salad. It includes AI Reliability, a solution that’s actually met the challenge of helping enterprises decrease greenhouse gas emissions and improve asset performance—a rare case where “AI” and “sustainability” aren’t just marketing fluff. The company’s digital transformation tools are already being used in sectors ranging from energy to financial services, and their strategic alliance with SMX Group, LLC, is all about developing mission critical AI in secure environments.

Let’s talk numbers. As of the latest data, C3 AI Inc’s stock price hovers around $18.36 USD, giving it a market cap of roughly $2.53 billion USD. The company’s executive chairman, Thomas Siebel (yes, that Siebel), has been the driving force behind its expansion and innovation. But it’s not all smooth sailing: C3 AI Inc’s total liabilities stand at about $363.75 million USD, and while the company posted a cash flow of $70.26 million USD last quarter, its net income per share (EPS) is expected to be around -$0.33 USD. Revenue has dipped by about 5.40% over the last week, and technical analysis currently shows a neutral to sell rating—so the market’s view is cautious, if not outright skeptical.

Still, C3 AI Inc’s provision of enterprise artificial intelligence software has been met with optimism from some analysts, who expect the company’s focus on digital transformation and large-scale AI deployment to pay off as more enterprises look to modernize. Their AI applications, like the C3 AI Health Suite and C3 AI Financial Services Suite, are already enabling organizations to accelerate their digital transformation initiatives and improve operational efficiency.

Investing in C3 AI Inc is not for the faint of heart. The stock price has been volatile, and the company’s alpha—its performance relative to the market—has swung with the broader enterprise artificial intelligence sector. But for portfolios seeking exposure to the next wave of AI-driven business solutions, C3 AI Inc offers a unique angle. Just remember: risk is part of the package, and thorough analysis (not just a glance at the latest Yahoo Finance chart) is essential before adding this ticker to your portfolio.

As Thomas Siebel put it in a recent article, “C3 AI Inc is well-positioned to drive growth and innovation in the enterprise artificial intelligence market, and we’re excited about the opportunities ahead.” If you’re considering investing, keep an eye on the company’s development, cash flow, and how well it delivers on its mission to enable digital transformation at scale. In the world of AI stocks, C3 AI Inc is a name to watch—but only if you’re ready for the ride.

The Real AI Winners (Spoiler: It’s Not Who You Think)

Artificial intelligence is a powerful force, and a handful of AI stocks are actually building the backbone of the revolution—not just talking about it. High trading volume in these stocks often signals genuine investor interest, helping to distinguish real winners from hype-driven plays. Here are some companies making real money, not memes:

1. NVIDIA (NVDA): The Pick-and-Shovel King

NVIDIA is the shovel merchant of the AI gold rush. Their GPUs power everything from OpenAI’s models to Tesla’s autopilot systems. NVIDIA plays a crucial role in deploying AI infrastructure across various industries, enabling businesses to operationalize advanced AI solutions at scale. In 2024, NVIDIA’s data center revenue tripled, driven by demand for enterprise AI applications and large scale AI deployment. However, with a price-to-earnings ratio north of 70, investors are betting on flawless execution. Any misstep could trigger a market tantrum, but NVIDIA remains one of the most watched AI stocks on the New York Stock Exchange.

2. Microsoft (MSFT): The Quiet Empire

While startups shout about AI, Microsoft quietly embeds AI across its products—Office, Azure, GitHub Copilot—and turns AI into subscription cash flow. Their strategic alliance with OpenAI was a calculated power play, not a gamble. Microsoft’s enterprise AI applications span customer relationship management solutions, predictive analytics, and digital transformation initiatives. This steady execution makes Microsoft a top contender in AI investing.

3. Palantir (PLTR): The Military Mind of AI

Once dismissed as “Big Brother for data,” Palantir now powers government and enterprise AI decisions globally. Their intelligence suite supports municipal law enforcement agencies, local governments, and government programs with mission critical AI applications. Palantir has also deployed AI solutions for state government agencies, enabling advanced analytics and decision-making across a range of public sector needs.

Palantir’s health suite accelerates healthcare innovation, while their local government suite helps county property assessors with both commercial property appraisal and residential property appraisal. Their systems can retrieve and present information from multiple disparate data sources, streamlining workflows for government agencies. Though not flashy, Palantir’s government contracts provide stable revenue and profits.

4. AMD (AMD): The Underdog With Momentum

AMD’s new MI300 chips challenge NVIDIA’s dominance, especially in operating large scale AI and energy management applications. Partnerships with hyperscalers like Amazon and Microsoft are turning into serious revenue streams. Baker Hughes is also a major partner, working with AMD to deploy advanced AI solutions for the energy sector. If NVIDIA is the emperor, AMD is the insurgent with a rocket launcher, making it an AI stock to watch closely.

The “AI-Adjacent” Pretenders

Companies like C3 AI Inc, SoundHound, and BigBear.ai are riding the AI narrative like it’s 2021 all over again. Their valuations depend heavily on future potential rather than current earnings or cash flow. This doesn’t make them scams, but it does make them speculative. The Motley Fool has also highlighted the risks associated with investing in speculative AI stocks, often cautioning investors to be mindful of volatility and uncertain long-term prospects. Investing in speculative AI stocks requires discipline and a clear understanding of risk.

AI Stock Investing: How to Avoid Getting Played

If you want to participate in the AI revolution without donating your portfolio to hype traders, here are some intelligent strategies:

Consider creating a watchlist of AI stocks to monitor their performance and stay updated on relevant news.

1. Follow the Infrastructure, Not the Influencers

Invest in AI stocks that build the AI economy—chips, cloud storage, energy management applications, and data infrastructure. Companies that develop and deploy enterprise AI applications at scale are especially valuable, as they provide end-to-end solutions for large organizations. Avoid companies that merely shout “AI” in press releases without substantive products.

2. Use ETFs to Spread the Risk

Exchange-traded funds like Global X Robotics & Artificial Intelligence ETF (BOTZ) or iShares Robotics and AI ETF (IRBO) let you ride the AI wave without betting on any single hype train. Diversification is key when dealing with volatile AI stocks.

3. Don’t Buy the Peak Narrative

If every financial headline screams “AI Will Change Everything,” it usually means smart money is already selling. For example, AI reached its all-time high on Dec 23, 2020, illustrating how market timing can be crucial. The best time to buy is often when the headlines say, “AI Hype Is Over.”

4. Read Earnings, Not Tweets

The fastest way to spot BS in AI stocks is to compare marketing claims with quarterly earnings reports. Revenue talks; buzzwords walk. Use resources like Yahoo Finance and Morningstar to analyze financials and technical analysis.

Most AI stocks do not currently pay dividends, which means investors looking for regular dividend income may find them less appealing compared to traditional dividend-paying stocks. This is an important factor to consider when evaluating the overall financial performance and investor appeal of AI companies.

5. Have an Exit Plan

Even legitimate AI stocks will experience corrections. Set stop-losses and take profits systematically before the next hype cycle buries you. Discipline is crucial in managing risk.

Witty Investor Verdict: Be the Algorithm, Not the NPC

Most investors chasing AI stocks in 2025 are reacting, not strategizing—they’re playing a video game without the controller. The winners won’t be those shouting “AI TO THE MOON,” but those who understand cash flow, fundamentals, and human psychology.

Don’t be the liquidity someone else exits through. Be the algorithm that calculates when the music stops. Remember, the real money in AI stocks is made by those building infrastructure, not by chasing headlines. Invest wisely, stay disciplined, and never forget that AI stocks—like any investment—require due diligence, not just hype.

Want to stay ahead of the AI stocks game? Subscribe to Witty Investor’s newsletter for weekly analysis on which AI stocks are worth your money—and which ones are just expensive lessons waiting to happen.

till Here? Feed That Financial Curiosity

If you made it this far without rage-selling your AI stocks, congrats — you’re already smarter than half of Reddit.

But don’t stop now. Keep your brain compounding with a few more Witty Investor favorites:

💥 Market Panic Investing: How Smart Investors Profit When Everyone Else Panics (2025 Edition)

Learn how to buy when everyone’s screaming “unprecedented times.”

🧠 The Psychology of Panic Selling: Why Investors Keep Shooting Themselves in the Foot

Your brain is your worst financial advisor. Let’s fix that.

⚖️ Witty or Risky? The Financial Face-Off Series

Where we pit hyped-up assets against common sense — and let sarcasm decide the winner.