Apple Stock: The Cult, The Cash, and The Chaos – A Brutally Honest Analysis

Is Apple the ultimate value trap or the smartest long-term play in tech? Here’s what the numbers really tell us.

Apple Stock: The Uncomfortable Truth About Apple’s Cult Following

Let’s address the elephant in the room: Apple doesn’t just have customers—it has disciples. The kind of people who treat every iPhone launch like a religious pilgrimage. When was the last time you saw people camping outside a Best Buy for a refrigerator upgrade? Exactly. But swap in an Apple Store, toss a new iPhone on the altar, and suddenly you’ve got sleeping bags, folding chairs, and tech bros treating Tim Cook like the Pope of Cupertino.

This isn’t normal consumer behavior—it’s cult-like devotion. Apple’s marketing isn’t just selling phones; it’s selling belonging, status, and that warm fuzzy feeling you get when someone sees the little glowing fruit logo on your laptop at Starbucks. You’re not just buying a product—you’re buying an identity.

Now here’s the problem for investors: cults make terrible financial decisions. Fanboys don’t care about slowing revenue growth, rising competition, or regulatory heat. They only care that the next iPhone comes in “Midnight Titanium Gray” or whatever shade of overpriced cool Apple convinces them to crave. That kind of blind loyalty might keep the cash registers humming, but it also creates a dangerous distortion for investors. When you’re emotionally attached to a brand, you stop looking at the cold, hard numbers—and the numbers are where reality lives.

The result? A stock that trades less on fundamentals and more on faith. And faith, last time I checked, doesn’t pay dividends.

The Reality Check:

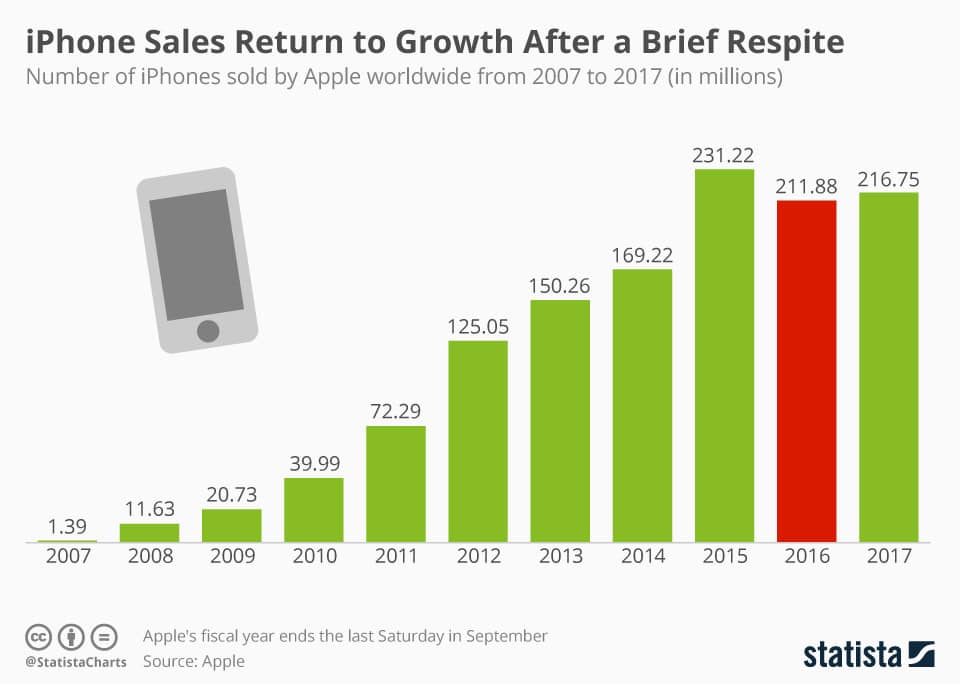

- iPhone revenue growth has been slowing for years

- Q3 2024: iPhone sales down 1% year-over-year

- Q4 2024: barely up 6%

- Global smartphone market share: just 15%

This isn’t the hockey-stick growth that justified Apple’s trillion-dollar valuation. Yet somehow, the stock trades like Apple owns the entire smartphone universe.

Apple’s “Digital Crack Dealer” Business Model (And Why It’s Genius)

Here’s where Apple’s story takes a turn from shiny hardware to something far more lucrative—and a little more sinister. The iPhone may be the billboard, but it’s no longer the business model. Apple figured out a long time ago that hardware is just the gateway drug. The real money? Services. And the way they run it looks suspiciously like a sophisticated digital drug dealer.

The Hook Strategy

- Hardware as bait: Sell you the beautiful, premium iPhone

- Lock you in: Make switching painful with ecosystem integration

- Extract recurring revenue: App Store fees, iCloud storage, subscriptions

The Numbers Don’t Lie

Services Revenue Breakdown:

- Q4 2024: $22+ billion quarterly

- Growth rate: 14% year-over-year

- Gross margins: 70%+ (vs 35% for hardware)

- Customer retention: Over 90% stick with iPhone

This is Warren Buffett’s dream investment: a toll bridge on digital life itself. Once you’re in Apple’s ecosystem, you’re essentially an economic hostage. Your photos, apps, and digital life are locked in their walled garden.

The Valuation Dilemma for Apple Stock: Premium Price for Premium Problems

So here’s the million-dollar question: are investors paying for overpriced fruit… or buying into a golden orchard that never stops producing cash? The answer, of course, depends on how allergic you are to paying premium prices for premium problems.

Let’s start with the bull case—the glossy brochure Apple fans would hand you if they were moonlighting as financial advisors:

The Bull Case Numbers

- Cash reserves: $162 billion (more than most countries’ GDP)

- Services growth: Highest-margin segment still expanding

- AI opportunity: “Apple Intelligence” integration just beginning

- Ecosystem strength: Switching costs remain prohibitively high

The Bear Case Reality

- P/E ratio: 29 (vs historical average of 16)

- Revenue growth: Slowest among major tech companies

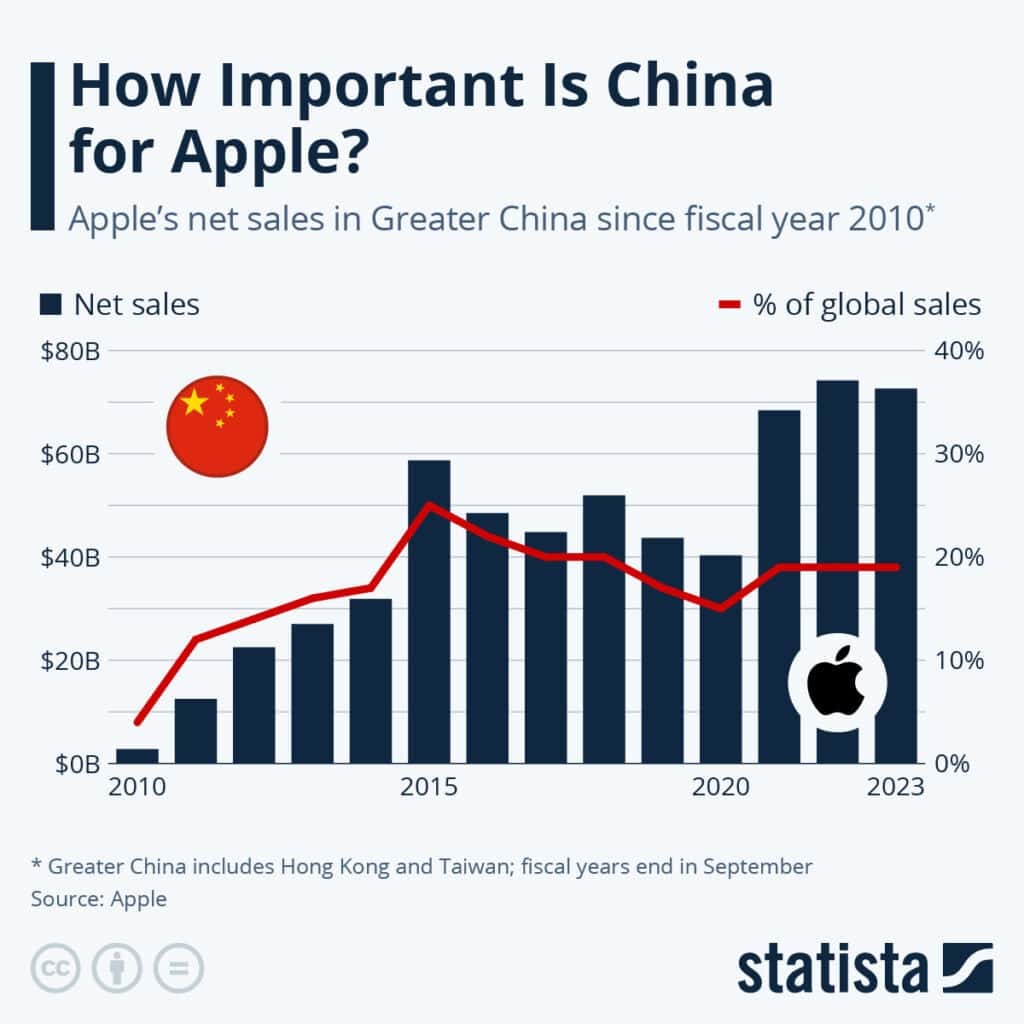

- China exposure: 20% of revenue from increasingly unstable market

- Regulatory pressure: EU forcing ecosystem changes

Competitive Context

When you compare Apple’s valuation to other tech giants:

Apple actually looks… reasonable? But here’s the catch: you’re paying a premium multiple for below-average growth.

The China Problem Nobody Wants to Talk About

Apple’s China exposure represents a massive, underappreciated risk:

- Revenue dependency: 20% of total revenue

- Manufacturing concentration: Most devices assembled in China

- Geopolitical tensions: Trade relationships increasingly unstable

- Local competition: Huawei, Xiaomi gaining ground domestically

This isn’t just a revenue risk—it’s an existential supply chain vulnerability that could crater the stock overnight if tensions escalate.

The AI Wild Card: Apple Intelligence or Artificial Ignorance?

Apple’s AI strategy could be either the next services goldmine or their biggest missed opportunity.

The Opportunity:

- Siri that actually works

- On-device AI processing advantage

- Privacy-focused AI services

- Subscription AI features

The Risk:

- Late to the AI party (again)

- Closed ecosystem limits AI training data

- Competition from ChatGPT, Google Assistant integration elsewhere

Investment Verdict: Witty or Risky?

After analyzing the fundamentals, here’s my brutally honest assessment:

Team Witty (Buy) Arguments:

✅ Unbreakable ecosystem with 90%+ retention

✅ Services goldmine with expanding margins

✅ Massive cash pile for acquisitions and innovation

✅ AI upside we haven’t seen yet

✅ Dividend potential with consistent cash generation

Team Risky (Skip) Arguments:

❌ Slowing growth across core products

❌ Premium valuation for below-average expansion

❌ China vulnerability could explode overnight

❌ Regulatory pressure threatening ecosystem moats

❌ Innovation concerns – where’s the next breakthrough?

The Bottom Line

Apple isn’t going anywhere. This is still one of the most powerful companies in human history, a brand that’s wormed its way so deeply into daily life that people panic more about losing their iPhone than their wallet. Its economic moat is the kind Warren Buffett dreams about when he’s not busy counting his billions—a fortress built on brand loyalty, switching costs, and a subscription model that prints cash like a Fed machine.

But here’s the rub: at today’s prices, you’re not buying the next Amazon-in-2008 story. You’re buying a company that has quietly transitioned from growth rocket to cash cow, while still dressing up in a black turtleneck pretending it’s a scrappy startup. Investors who expect explosive upside are basically showing up to a retirement party expecting a rave.

What Apple really is now:

- A dividend aristocrat in training, with steady buybacks and growing cash returns.

- A steady compounder for dollar-cost averagers who don’t mind modest growth with lower risk.

- A safety blanket stock—the one you hold because it makes you sleep better, not because it’s going to 10x.

If you’re a long-term investor who wants predictability, Apple still deserves a seat in your portfolio. If you’re chasing adrenaline, look elsewhere. The days of 300% moonshots are gone, replaced by the slow burn of consistent, almost boring wealth compounding.

So ask yourself: do you want a lottery ticket or a reliable paycheck? Apple’s stopped handing out winning numbers, but it’s still writing dividend checks with remarkable consistency.

My Investment Recommendation:

For long-term investors dollar-cost averaging over 5-10 years: Probably fine. Apple will likely compound wealth steadily.

For growth investors looking for the next 10-bagger: Look elsewhere. The explosive growth phase is over.

For value investors: Wait for a better entry point. Market corrections happen, and Apple typically gets swept up in them.

What This Means for Your Portfolio

Apple stock today represents the investment equivalent of buying a luxury car: you’re paying a premium for quality and brand prestige, but don’t expect extraordinary returns relative to the price paid.

The company will likely continue generating enormous cash flows, rewarding shareholders with dividends and buybacks. But the days of 300%+ stock gains are probably behind us.

The smart play? If you don’t own Apple, wait for a market correction to build a position. If you already own it, hold but don’t get greedy expecting massive upside from current levels.

What do you think? Is Apple a witty long-term hold or a risky overvaluation? Share your thoughts in the comments below.

Disclaimer: This analysis is for educational purposes only and should not be considered personalized financial advice. Always conduct your own research and consult with financial professionals before making investment decisions. Past performance does not guarantee future results.