Raw Land Due Diligence: 7 Non-Negotiable Checks Before You Sign the Deed

Raw Land Due Diligence: 7 Non-Negotiable Checks Before You Sign the Deed (The Reality Check Edition)

Imagine standing on a pristine plot of 40 acres, the sun setting over a ridge you now own. It’s the ultimate dream for many outdoor enthusiasts and investors: a private asset or a slice of wilderness for camping. But that dream can turn into a financial nightmare faster than you can say “wetlands designation.” Thousands of eager buyers purchase land every year only to discover they can’t build, camp, or even legally access their own property because they failed to perform basic raw land due diligence.

Before you hand over your hard-earned cash and commit to that mortgage, you must bridge the gap between fantasy and reality. By performing thorough raw land due diligence, you protect your wallet and ensure your land can actually support your investment goals. Listen, if you want a money pit, there are easier ways to find one—like day trading penny stocks. If you want a usable asset, you need to execute serious raw land due diligence. Read on to discover the seven non-negotiable checks that separate a smart land purchase from a financial black hole.

[Image Description: A wide landscape shot of a beautiful, rugged piece of raw land with a “For Sale” sign in the foreground, symbolizing the potential purchase.]

What is Raw Land Due Diligence? (And Why You’re Not Special)

Raw land due diligence is the comprehensive, often grueling process of investigating a property’s physical, legal, and financial attributes before finalizing a purchase. Unlike buying a home, where a standard inspection covers most issues, raw land requires you to investigate invisible factors like arcane zoning laws, finicky soil composition, and deed restrictions put in place by some long-dead curmudgeon.

It is the investigative homework you do to verify that the land is what the seller says it is and that it can be used for your intended purpose. The best investors treat raw land due diligence like a pre-audit. Frankly, skipping raw land due diligence means you’re just gambling with six figures.

Reasons You Need to Know Due Diligence

Skipping this crucial step is the most common reason land deals go sour, resulting in what we in the industry call “an expensive patch of weeds.” Without proper raw land due diligence, you risk buying a property that is “landlocked” with no legal road access, or purchasing a plot where local zoning laws prohibit camping or building. You might even inherit thousands of dollars in back taxes or liens attached to the property—congratulations, you just bought someone else’s problems!

| Due Diligence Factor | Potential Problem Avoided | Cost of Problem (Avg.) |

| Legal Access | Cannot drive to your property (Landlocked) | $15,000 – $50,000 (Easement litigation) |

| Buildability (Perc Test) | Cannot install septic system | Property is unbuildable (Total loss or 50% value drop) |

| Flood Zone | Astronomical insurance premiums | $2,000 – $5,000/year in insurance |

| Utility Proximity | Connecting power costs a fortune | $10,000 – $50,000 (Line extension) |

Why this skill is critical for your investment portfolio:

- Legal Access: Confirms you can actually drive to your property without trespassing. This is the bedrock of raw land due diligence.

- Buildability: Confirms the ground can support a foundation and handle a septic system (The “perc test” is non-negotiable for raw land due diligence).

- Cost Control: Reveals hidden costs like bringing power lines to the site or drilling deep wells.

- Usage Rights: Verifies you are legally allowed to hunt, camp, or park an RV on the land.

- Title Clarity: Ensures no hidden debts or liens from the past owner will become your immediate liability. This is a critical part of raw land due diligence.

By following a structured raw land due diligence process, you eliminate the guesswork. This method acts as your safety net, ensuring that when you finally sign that deed, you are buying freedom, not a liability. Raw land due diligence is how the pros do it.

Step-by-Step Instructions to Vet Raw Land: The Seven Seals of Disclosure

Navigating county records and legal documents can feel overwhelming, but if you want to be a successful investor, you need to get over it. My process breaks down the complex world of land feasibility into seven distinct, manageable checks. By tackling these one by one, you build a complete picture of the property’s potential. Every investor knows the importance of raw land due diligence.

The 7 Non-Negotiable Checks for raw land due diligence:

- Zoning and Land Use Verification

- Legal Access and Easement Check

- Utilities and Infrastructure Feasibility

- Topography, Soil, and Flood Zone Analysis

- Title Search and Lien Investigation

- HOA and Covenant Review

- Survey and Boundary Confirmation

Now that you have the roadmap, let’s dive into the specific details of each check so you can assess your potential property with the cold, calculating confidence of a professional. This is the core of raw land due diligence.

1. Zoning and Land Use Verification: The County’s Iron Fist

This is your first stop because it dictates what is legally possible on the land. Just because it looks like the perfect spot for an A-frame cabin doesn’t mean the county will let you build one. This is the non-negotiable starting point for raw land due diligence.

Call the county planning and zoning department and ask for the specific zoning classification of the parcel (e.g., Residential, Agricultural, Recreational). Ask specific questions: “Is camping allowed?” “What are the minimum square footage requirements for a dwelling?” “Are mobile homes or RVs permitted for full-time living?” If your dream is an off-grid tiny home, but the zoning requires a minimum 1,500-square-foot structure, this land is a no-go. Don’t be shy; your time is money. This is a crucial element of raw land due diligence.

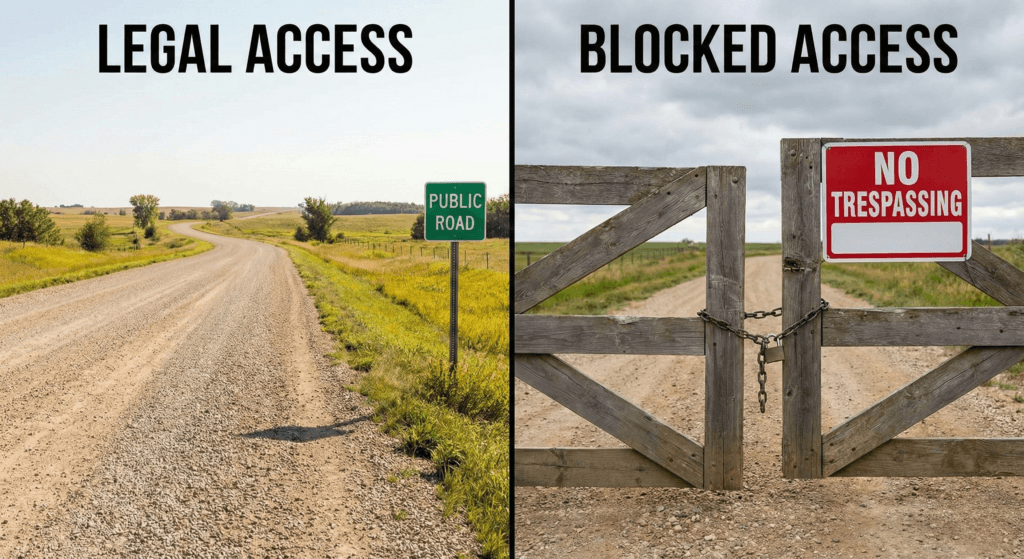

2. Legal Access and Easement Check: The Path Less Owned

Never assume that a dirt road leading to the property means you have the legal right to use it. “Landlocked” property is surprisingly common and can be a legal headache that will bankrupt your investment dreams. This part of raw land due diligence is essential.

Check the deed and county maps to verify there is recorded legal access. If the property does not touch a public road, you need a recorded easement across the neighbors’ land. Without this, you could be barred from crossing private property to get to your land. Do not rely on a seller’s verbal assurance; if it isn’t written in the deed or recorded at the county, it doesn’t exist. Period. A quick title search during raw land due diligence will reveal this.

To visualize the risk, consider this formula regarding access value:

$$Value_{risk} = \frac{MarketValue}{(1 + \text{LegalFees}) \times \text{AccessUncertainty}}$$

I’m sure this formula was clear as mud for you, it was for me. Haha

If Access Uncertainty is high, your value plummets.

3. Utilities and Infrastructure Feasibility: The Hidden Costs of Civilization

Unless you plan to be 100% primitive, you need to know how you will get water, power, and waste disposal. This phase of raw land due diligence is where the budget usually bleeds out.

- Power: Identify the nearest utility pole. If it’s over 1,000 feet away, extending the lines can cost $10,000 to $50,000 or more, depending on terrain and utility company fees. Get a quote.

- Water: If no municipal water, you need a well. Research the average well depth in the area—drilling 600 feet is significantly more expensive than drilling 150 feet. Costs can range from $15/foot to $40/foot. External Link: USGS Groundwater Information

- Waste: You will likely need a septic system. This requires a “perc test” (percolation test) to ensure the soil drains well enough to filter wastewater. If the land fails the perc test, it is often unbuildable, regardless of your dreams. This is a non-negotiable test in raw land due diligence.

4. Topography, Soil, and Flood Zone Analysis: Mother Nature’s Obstacles

Land that looks flat on a map might be a vertical cliff or a swamp in real life. Physical geography determines the usability of the acreage. Don’t just look at pictures; execute thorough raw land due diligence.

Use tools like Google Earth (with 3D view turned on) and FEMA flood maps. If the property is in a FEMA flood zone, insurance will be astronomical, and building might be prohibited. External Link: FEMA Flood Map Service Center. Additionally, check for wetlands using the US Fish and Wildlife Service’s National Wetlands Inventory. Wetlands are federally protected, meaning you cannot drain or build on them without expensive and difficult-to-obtain permits. External Link: USFWS Wetlands Mapper. This step in raw land due diligence is crucial.

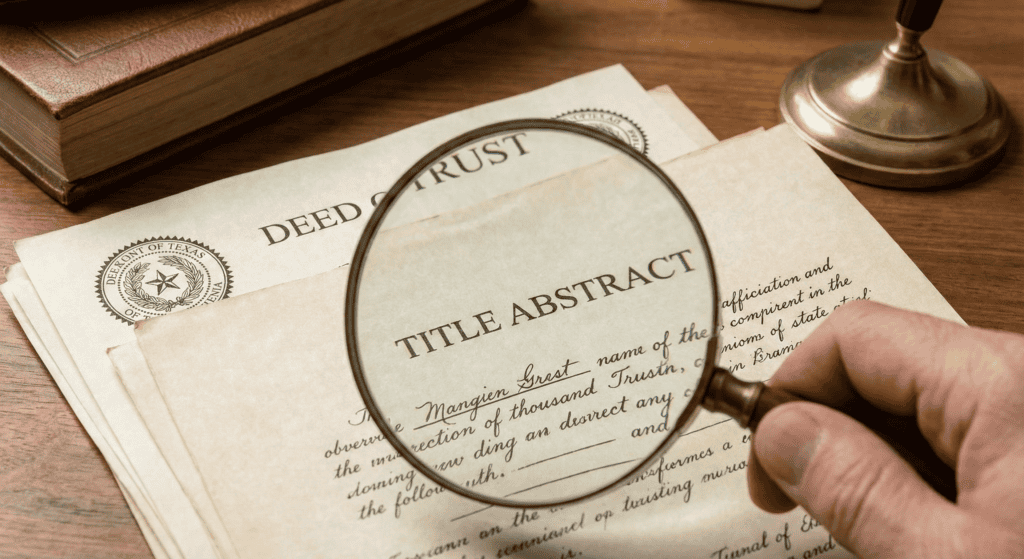

5. Title Search and Lien Investigation: The Land’s Debt History

You want to own the land, not the previous owner’s debts. A title search ensures the seller actually has the right to sell the property and that it is free of encumbrances. Without this, your raw land due diligence is incomplete.

Hire a title company or attorney to do a deep dive into the county clerk’s records. Look for unpaid property taxes, mechanic’s liens (unpaid contractors), or mortgage liens. If there are “clouds” on the title, the sale cannot proceed cleanly. This step confirms that once you pay, the land is 100% yours. Title insurance is highly recommended after your initial raw land due diligence to protect against any missed issues.

6. HOA and Covenant Review: The Neighborhood Tyrant

Many rural properties are part of loose subdivisions that have HOAs (Homeowners Associations) or CC&Rs (Covenants, Conditions, and Restrictions). These can be even more restrictive than county zoning. They exist to destroy your fun. Your raw land due diligence must include this.

Request a copy of the CC&Rs immediately. These documents can dictate everything from the color of your roof to whether you are allowed to raise chickens or park a boat. Even in remote areas, a strict covenant can destroy your plans for a homestead. If the rules say “no temporary structures,” your plan to live in a camper while you build is dead in the water. This is an often-overlooked part of raw land due diligence.

7. Survey and Boundary Confirmation: Measure Twice, Cut Zero Times

Fences and tree lines are rarely accurate indicators of property lines. Relying on them can lead to building your cabin on your neighbor’s land—a mistake that costs tens of thousands to fix. This is the final and crucial check in raw land due diligence.

If a recent survey has not been recorded, hire a licensed surveyor to mark the corners. This shows you exactly what you are buying. It reveals encroachments (like a neighbor’s shed sitting on your land) and verifies the acreage. A parcel listed as 10 acres might actually be 8.5 acres once surveyed. This simple verification is key to successful raw land due diligence. External Link: National Society of Professional Surveyors

Key Considerations For Successfully Buying Raw Land

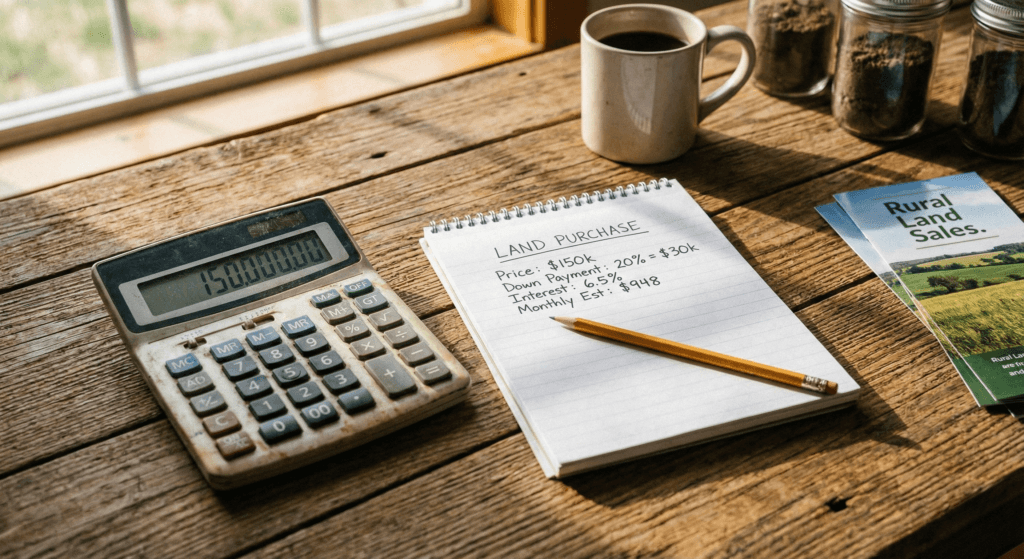

While the seven checks above cover the technical side, there are financial nuances to consider. Financing raw land is significantly harder than buying a house. Banks view land as a riskier asset because you can walk away from it more easily than a home you live in. Expect to put down a deposit of 20% to 50% and pay higher interest rates. Your raw land due diligence should include a financial feasibility study.

| Financing Type | Average Down Payment | Average Interest Rate Spread (over 30yr fixed) |

| Residential Home | 3% – 20% | Base Rate (0) |

| Developed Land | 10% – 30% | +1% to +2% |

| Raw Land | 20% – 50% | +2% to +5% |

Insurance is another factor often overlooked. Even if there is no structure, you need liability insurance, especially if you plan to let friends hunt or camp on the land. If someone twists an ankle on your rocky terrain, you want to be covered.

Taking it to the Next Level: Professional Environmental Studies

If you are looking at a large parcel (50+ acres) or land with a history of industrial use, the basic raw land due diligence might not be enough. You may want to invest in a Phase I Environmental Site Assessment (ESA).

This involves hiring an environmental professional to inspect the history of the land for contamination, such as old underground gas tanks, illegal dumping sites, or hazardous waste. While this costs money upfront (usually $2,000 to $3,000), it saves you from inheriting a federal cleanup liability that could bankrupt you. Ignorance is not a defense, especially when dealing with the EPA. A full-scale raw land due diligence often includes this. External Link: EPA Brownfields Program

Alternatives to Buying Raw Land

If the raw land due diligence process sounds too daunting or risky, there are alternatives to buying completely raw, undeveloped land.

One option is buying “improved” land. This is a lot where the previous owner has already installed a driveway, dropped a septic tank, or pulled power to the site. It costs more upfront but removes the biggest variables identified in your raw land due diligence. Another alternative is land leasing. If your goal is strictly recreational—like hunting or weekend camping—you can lease a large tract of land for a year. This gives you the adventure experience without the tax burden, maintenance, or capital commitment of ownership.

Wrapping Up and My Experience With Land Ownership

Raw land due diligence is the unglamorous shield that protects your adventurous dreams. I have seen too many people buy a plot because the view was pretty, only to find out six months later that they own an expensive picnic spot they can never build on. By methodically working through these seven checks—Zoning, Access, Utilities, Topography, Title, HOA, and Survey—you ensure that your investment is sound. Successful raw land due diligence makes all the difference.

At The Witty Investor, we believe land should be a performing asset, not a liability that eats your capital. Take your time, do the research, and when you finally sign that deed, do it knowing you have secured a true legacy. The ability to perform thorough raw land due diligence is the single greatest skill a land buyer can possess. If you commit to detailed raw land due diligence, you will win.

❓ FAQ: The Land Due Diligence Hot Seat

Q: How long should raw land due diligence take?

A: Typically 30 to 60 days. Anything less is rushing; anything more means you’re procrastinating. The contract should always specify a raw land due diligence period.

Q: What is a “Perc Test” and why is it so important?

A: It’s a percolation test that measures how quickly water drains into the soil. If the soil drains too slowly, it can’t support a conventional septic system, making the land unbuildable for a permanent dwelling. It is a vital part of raw land due diligence.

Q: Do I really need a surveyor if there are corner markers?

A: Yes. Fences or old posts can be decades old and inaccurate. Only a licensed surveyor performing a new survey can legally guarantee the boundary lines. This prevents massive legal headaches down the road and is essential to proper raw land due diligence.

Q: What happens if I find a lien during the Title Search?

A: The seller is generally responsible for clearing the lien before closing. The title company will use the proceeds from the sale to pay off the lien, ensuring you receive a clear title. Never close until the title is clear. This is a fail-safe built into raw land due diligence.

Q: Is it smart to skip raw land due diligence for a small, cheap parcel?

A: Absolutely not. A $5,000 “cheap” parcel with no access or failed perc test is a $5,000 waste of money. The cost of raw land due diligence is a fraction of the cost of a mistake.

Disclaimer: The content of this post is based on the author’s personal experience and is for informational purposes only. It should not be considered professional legal or financial advice. Always perform your own due diligence and consult with local experts before signing a deed.