Turkey-Brained Money Moves: The 7 Financial Mistakes Everyone Makes During the Holidays

(A brutally honest guide for anyone who thinks “But it was 40% off!” counts as financial literacy.)

Every year, millions of people sit down for Thanksgiving dinner and promptly make the same financial mistakes they made last year. And the year before that. And the year before that. It’s tradition — like turkey, stuffing, and pretending you enjoy talking to your cousin who keeps pitching you crypto you’ve never heard of.

Between Black Friday panic-buying, guilt-gifts, and emotional eating that somehow costs $187 at Whole Foods, the holidays are a financial minefield. Not because things are expensive (which they are), but because humans are walking behavioral bias machines with a soft spot for “limited time offers.” These turkey-brained money moves happen with such predictable regularity that retailers build entire business models around exploiting them.

But here’s the good news: once you understand the psychology behind holiday overspending, you can finally stop making the same turkey-brained money moves as everyone else. You can glide into the New Year with cash, calm, and a functioning credit score — instead of debt, regret, and a $72 scented candle you bought for “self-care.”

Let’s carve up the seven biggest Thanksgiving-and-holiday-season money mistakes — and how to avoid them without becoming a Grinch, a scrooge, or that one uncle who still complains about the price of gas in 1993. Understanding these turkey-brained money moves is the first step toward breaking the cycle.

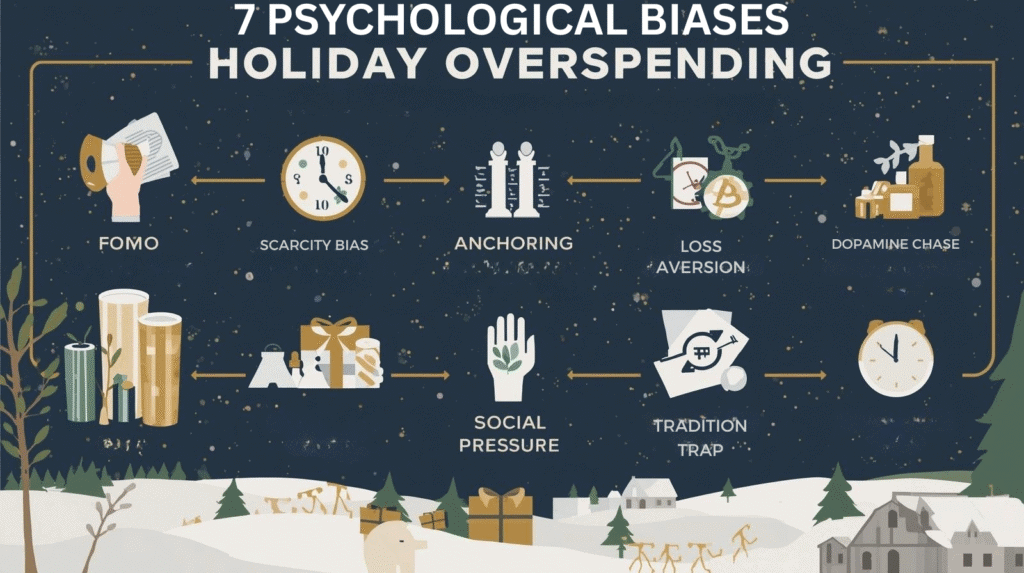

The 7 Turkey-Brained Holiday Money Moves (And How to Outsmart Them)

1. Panic-Buying on Black Friday Like the Deals Are Oxygen

The human brain sees scarcity and loses all ability to think clearly.

A toaster goes from $59.99 to $29.99 and suddenly it becomes a must-have survival item — despite the fact that your current toaster works perfectly and you only eat bread like twice a week. This is perhaps the most classic of all turkey-brained money moves, and retailers have perfected the art of exploiting it.

The Psychology: Scarcity bias meets fear of missing out — a toxic combination that explains why people trample each other at Walmart over discounted televisions they don’t need. According to research from the National Retail Federation, the average American spends over $1,000 during the holiday season, with Black Friday serving as the psychological trigger point that opens the spending floodgates.

Retailers use artificial scarcity to create urgency. “Only 3 left in stock!” doesn’t mean the item is rare — it means the algorithm knows you’re about to impulse-buy and wants to close the deal before rational thought returns. The doorbuster deal that gets you in the store at 5 AM? That’s called a loss leader, and the store has exactly 12 of them. Everything else you buy while you’re there is where they make their profit. These turkey-brained money moves generate billions in retail revenue annually.

Use price tracking tools like CamelCamelCamel for Amazon purchases — you’ll discover that “amazing Black Friday deal” is often the same price the item was three weeks ago. These turkey-brained money moves rely on you not doing basic research. The more you investigate actual price histories, the less magical those “deals” become.

2. Hosting Like You’re Jeff Bezos on a Holiday Special

People overspend on Thanksgiving dinner because they fear being judged by relatives who, let’s be honest, still think instant potatoes are gourmet.

The average Thanksgiving dinner costs between $60-$90 per person when you factor in the turkey, sides, desserts, drinks, and that one specialty item someone demanded from Whole Foods. Multiply that by 10-15 guests, and you’re looking at a $900-$1,350 meal. These hosting-related turkey-brained money moves destroy November budgets faster than you can say “farm-to-table.”

The Psychology: Social pressure plus self-image bias creates a perfect storm of overspending. You want to be “the good host,” not “the person who forgot the cranberry sauce” or worse, “the one who served store-brand rolls.” Your ego writes checks your savings account can’t cash.

This taps into what behavioral economists call signaling theory — you’re using consumption to signal your status, competence, and worth to your social group. The problem? Your relatives aren’t going to remember your $47 artisanal butter, but your January credit card statement definitely will. These status-driven turkey-brained money moves satisfy your ego while bankrupting your budget.

How to Outsmart It: Potluck that thing. Seriously. Assign dishes strategically based on people’s competencies and budgets. Nobody needs five different pies unless you’re running a bakery.

Buy generic for ingredients nobody notices — flour, butter, sugar, spices. Save the premium purchases for the hero items like the turkey itself. Shop at discount grocers like Aldi or Costco for bulk items. And remember: nobody likes your cousin’s gluten-free experimental stuffing anyway — it’s okay to assign it to them and save yourself $30 on specialty flour. Avoiding these hosting turkey-brained money moves doesn’t make you cheap; it makes you financially intelligent.

3. Buying Gifts Out of Guilt, Obligation, or Emotional Damage

Holiday gift-giving is 70% guilt, 20% default behavior, and 10% “I don’t want to look cheap.” These guilt-driven turkey-brained money moves explain why Americans spend over $1,000 on holiday gifts annually, according to Gallup’s holiday spending survey.

The Psychology: Loss aversion plus emotional spending creates a dangerous feedback loop. You’re afraid of disappointing someone, so you overcorrect with money. The pain of social rejection feels more intense than the pain of overspending, so your brain chooses financial damage over social risk.

This connects directly to reciprocity bias — when someone gives you a gift, you feel obligated to match or exceed its perceived value. The result? An arms race of increasingly expensive presents that nobody wanted in the first place. Add in performative generosity (especially on social media), and you’ve got a recipe for financial disaster wrapped in festive paper. These reciprocity-driven turkey-brained money moves trap people in expensive gift exchanges year after year.

How to Outsmart It: Set a budget. Communicate it early. And remember: most people don’t want more things. They want attention, validation, or just for you to show up on time.

Implement a Secret Santa system for extended family — one $30-$50 gift instead of 15 smaller ones saves money and reduces stress. For kids, follow the “something they want, something they need, something to wear, something to read” formula to cap spending while appearing thoughtful.

Consider experience gifts — concert tickets, cooking classes, or museum memberships — which create memories without cluttering people’s homes. These alternatives help you avoid the classic turkey-brained money moves that leave everyone broke and surrounded by unwanted stuff. Breaking the gift-giving arms race is one of the most liberating financial decisions you can make.

4. Mistaking “Sale” for “Smart”

A sale means one thing: the store wants your money today, not tomorrow.

People see “50% OFF” and lose IQ points. They’ll spend $100 on items they don’t need just to “save” $100 on the original price. This is some Olympic-level mental gymnastics, and it’s one of the most common turkey-brained money moves in the holiday playbook.

The Psychology: Anchoring bias hijacks your rational decision-making process. You anchor on the original price and assume the deal is good without questioning whether that original price was legitimate. Many retailers artificially inflate prices before major sales so the “discount” looks impressive. That $200 jacket marked down to $99? It was probably manufactured to hit that $99 price point all along.

The Federal Trade Commission has actually cracked down on fake sale pricing, but enforcement is spotty. JCPenney famously got sued for this practice — putting items “on sale” for 364 days per year with the “regular price” showing for maybe 24 hours. Understanding how retailers manipulate anchoring bias helps you avoid these perception-based turkey-brained money moves.

How to Outsmart It: Ask one question: “Would I buy this at full price?” If the answer is no → don’t buy it. If the answer is yes → congratulations, you’re becoming financially literate and avoiding turkey-brained money moves.

Use the price-per-use calculation: if you spend $100 on something you’ll use 100 times, that’s $1 per use — reasonable. If you spend $30 on something you’ll use twice, that’s $15 per use — terrible economics regardless of the discount percentage.

Check price histories using browser extensions like Honey or Karma. Track the item for two weeks. If it’s genuinely cheaper, great. If not, you’ve just saved yourself from retailer manipulation and another round of turkey-brained money moves that would have depleted your savings.

5. Overspending Because of Holiday Dopamine Addiction

The holidays activate every reward center in your brain: lights, music, sugar, people you tolerate, limited-edition Starbucks drinks, ads featuring unrealistic families with matching pajamas. This neurochemical cocktail makes you financially stupid and drives some of the most predictable turkey-brained money moves of the season.

The Psychology: Dopamine addiction isn’t just for drugs and social media — it’s the reason Target receipts look like crime scene evidence. Your brain releases dopamine in anticipation of reward, not just when receiving it. This is why browsing online stores feels good even before you buy anything.

According to research published in the Journal of Consumer Psychology, holiday shopping triggers the same neural pathways as gambling. The “rush” of finding a deal or buying the perfect gift creates a feedback loop that encourages more spending. Retailers know this, which is why everything is designed to maximize that dopamine hit — the music, the scents, the limited-time offers.

Add seasonal depression (seasonal affective disorder affects millions during darker winter months) and you’ve got retail therapy meeting clinical psychology. People literally self-medicate with shopping, creating turkey-brained money moves that feel good temporarily but cause lasting financial damage. The dopamine-driven spending cycle represents perhaps the most insidious category of turkey-brained money moves because it feels like self-care while destroying your finances.

How to Outsmart It: Wait 24 hours before any non-essential purchase. The dopamine wears off. The clarity returns. The wallet survives. I could have saved thousands of dollars over my lifetime, if I would listen to my own advice!

Unsubscribe from promotional emails during November and December. Delete shopping apps from your phone’s home screen. Use website blockers during work hours if necessary. These aren’t extreme measures — they’re rational responses to sophisticated psychological manipulation designed to trigger turkey-brained money moves.

Practice the “one in, one out” rule: for every new item you buy, donate or discard something you already own. This creates friction that forces you to evaluate whether you truly want the item or just the dopamine hit that comes with these neurochemistry-driven turkey-brained money moves.

6. Traveling at Peak Price Season Because “It’s Tradition”

Nothing says “fiscal irresponsibility” like paying $900 for a flight so you can sit in a living room listening to the same stories you’ve heard since 2004. Holiday travel represents some of the most expensive and yet most predictable turkey-brained money moves in personal finance.

I am torn on this idea. I believe family is one of the most important things in life. So this leaves me torn.

The Psychology: FOMO (fear of missing out) plus tradition trap creates a psychological pincer movement. You think, “If I don’t go, I’ll regret it!” or “Family will be disappointed!” Spoiler: maybe you won’t regret it, and maybe they’ll get over it.

This taps into sunk cost fallacy and status quo bias simultaneously. You’ve always traveled for Thanksgiving, therefore you must continue traveling for Thanksgiving, regardless of whether it makes financial or even emotional sense anymore. The tradition itself becomes the justification, even when the math doesn’t work.

Airlines use dynamic pricing algorithms that identify high-demand periods and adjust accordingly. The Wednesday before Thanksgiving is consistently one of the highest-traffic travel days of the year, meaning airlines have zero incentive to offer discounts. You’re competing with millions of other people making the same turkey-brained money moves. The travel industry profits massively from consumers who refuse to question tradition-based spending.

How to Outsmart It: Travel off-peak. Fly on Thanksgiving Day itself (seriously — it’s cheaper and less crowded). Or the Monday/Tuesday before. Or the Friday after. Shift your celebration by a weekend and save 40-60% on airfare.

Or host instead. When you calculate the total cost of travel (flights, rental car, pet boarding, time off work), hosting often costs less and reduces stress. Or do a digital Thanksgiving — it’s 2025, nobody will judge you, and your bank account will thank you.

Consider alternating years: visit family one year, host or stay home the next. This reduces the financial burden while maintaining family connections over the long term. Breaking free from tradition-based turkey-brained money moves requires courage, but the financial payoff is substantial.

7. Eating Your Budget Like You Eat Pumpkin Pie

Between groceries, snacks, drinks, desserts, and stress-eating… your wallet doesn’t stand a chance. Food-related turkey-brained money moves don’t just happen on Thanksgiving Day — they compound throughout November and December as you navigate office parties, social gatherings, and emotional eating triggered by family stress.

The Psychology: Short-term gratification meets emotional regulation through consumption. Food is emotional anesthesia with a receipt. When stressed, humans seek comfort through caloric density and flavor variety — both of which cost money.

The holidays also trigger what psychologists call decision fatigue. After making hundreds of micro-decisions about gifts, travel, hosting, and social obligations, your willpower depletes. By evening, you’re vulnerable to every food-related impulse: delivery apps, premium snacks, restaurant meals, expensive coffee drinks. This is why grocery store candy sections are at checkout lines — they’re catching you at your weakest decision-making moment and capitalizing on your vulnerability to food-based turkey-brained money moves.

How to Outsmart It: Meal plan like a grown adult. Shop with a list. Buy generic for staples. And stop pretending the $14 artisanal cranberry sauce tastes different from the $2 can — blind taste tests consistently show people can’t tell the difference.

Prep freezer meals before the holiday chaos begins. Batch-cook soups, casseroles, and proteins so you’re not vulnerable to expensive takeout when exhausted. Use grocery pickup services to avoid impulse purchases.

Track your food spending separately during the holidays. Most people have no idea they’re spending $600-$800 extra on food between Thanksgiving and New Year’s. Awareness alone reduces spending by 15-20%. Monitoring these consumption-driven turkey-brained money moves is the first step toward controlling them.

Key Considerations (A.K.A. The Part Where You Become Less of a Money Gobbler)

✔ Stick to a holiday budget

Yes, this requires opening a spreadsheet. You’ll survive. Break it down by category: gifts, food, travel, decorations, charitable giving. Allocate dollar amounts before November 1st. These precommitments reduce turkey-brained money moves by creating clear boundaries before emotional spending begins.

Use zero-based budgeting: every dollar gets assigned a job. Money without a job becomes discretionary spending, which becomes regrettable purchases at 11 PM on Cyber Monday. Budgeting transforms vague spending intentions into concrete limits that prevent the most damaging turkey-brained money moves.

✔ Automate your savings

So you don’t blow your entire December paycheck on matching Christmas pajamas for the dog. Set up automatic transfers to a separate holiday savings account starting in January. By November, you’ll have a funded buffer that prevents credit card debt.

Consider the 12-month method: divide your projected holiday expenses by 12 and save that amount monthly. If you spend $3,000 on holidays, save $250 per month. This turns a quarterly financial crisis into a manageable monthly line item and prevents the desperate, last-minute turkey-brained money moves that happen when you haven’t prepared.

✔ Use cash for discretionary spending

When you see the physical money leave, you behave better. Humans are simple creatures whose brains process digital transactions differently than physical ones. The pain of payment is reduced when swiping plastic versus counting out bills.

Withdraw your discretionary spending budget in cash at the start of each week. When it’s gone, you’re done spending. This prevents the “I’ll just check my balance” trap that leads to overspending because you’ve lost track across multiple transactions. Cash-based spending eliminates many impulse-driven turkey-brained money moves simply by making the cost psychologically real.

✔ Don’t compare your holidays to Instagram

Those people are broke too — they’re just good at Lightroom. According to research from Credit Karma, 40% of Americans go into debt during the holidays, with many specifically citing social media pressure as a contributing factor. The highlight reels you see online rarely reflect financial reality.

Unfollow or mute accounts that trigger financial comparison anxiety during November and December. Your mental health and bank account will both improve. Remember: nobody posts their credit card statements next to their gift piles. Social comparison is a major driver of competitive turkey-brained money moves that serve ego instead of financial wellbeing.

Going Deeper: The Behavioral Economics of Holiday Spending

Understanding turkey-brained money moves requires examining the underlying behavioral economics. Loss aversion (losses feel twice as painful as equivalent gains feel good) means people overspend to avoid the “loss” of disappointing others or missing experiences.

Present bias causes people to overweight immediate pleasure and underweight future consequences. That’s why “buy now, pay later” services explode during holidays — they exploit your inability to accurately value future financial pain. These services essentially weaponize present bias to encourage turkey-brained money moves that shift pain into the future.

Mental accounting leads people to treat “holiday money” differently than “regular money,” creating permission for spending that would seem irrational in July. Breaking this cognitive compartmentalization helps reduce turkey-brained money moves across the board.

The endowment effect makes people overvalue things once they possess them, which explains why gift returns happen at such low rates even when gifts are unwanted. Understanding these biases doesn’t eliminate them, but it creates enough rational distance to make better decisions and interrupt the automatic turkey-brained money moves that happen when operating on psychological autopilot.

Wrapping It Up (With a Bow You Didn’t Overspend On)

The holidays are fun, chaotic, nostalgic, and extremely unkind to wallets. But with a tiny bit of financial awareness — and a whole lot of sarcasm — you can avoid the classic turkey-brained money moves most people make every single year.

Because nothing says “I’m leveling up” like ending the year with less debt, more clarity, and no shame purchases haunting your January bank statement. The turkey-brained money moves that destroyed your finances last year don’t have to repeat themselves.

Financial discipline during the holidays isn’t about being cheap or joyless. It’s about being intentional. It’s about spending on what matters and cutting ruthlessly on what doesn’t. It’s about entering 2026 with savings, not regret.

The best gift you can give yourself is financial stability. Everything else is just wrapping paper.

Happy Thanksgiving — and may all your purchases pass the 24-hour test. Here’s to a holiday season free from turkey-brained money moves, full of actual joy instead of buyer’s remorse, and characterized by memories rather than receipts. Breaking the cycle of predictable turkey-brained money moves is the ultimate act of financial self-respect.

FAQ Stuffing-Sized Answers to Turkey-Brained Questions

1. What are turkey-brained money moves? Turkey-brained money moves are predictable financial mistakes people make during the holiday season, driven by psychological biases, emotional spending, and retailer manipulation. They include panic-buying on Black Friday, guilt-driven gift purchases, overspending on hosting, and mistaking sales for smart financial decisions. These turkey-brained money moves cost Americans billions collectively each year.

2. How much does the average American overspend during the holidays? According to the National Retail Federation and Gallup surveys, Americans spend an average of $1,000-$1,500 during the holiday season on gifts, food, travel, and decorations. About 40% of Americans go into credit card debt specifically due to holiday spending, with many carrying that debt into March or beyond. These turkey-brained money moves create financial stress that extends far past the holiday season itself.

3. Why do people overspend on Black Friday? Black Friday overspending is driven by scarcity bias and fear of missing out (FOMO). Retailers create artificial urgency through limited quantities and time-sensitive deals, triggering impulsive purchasing decisions. The deals often aren’t as good as advertised — many “sale” prices match previous prices from weeks earlier. These Black Friday turkey-brained money moves generate massive retail profits while draining consumer savings.

4. How can I avoid impulse buying during the holidays? Wait 24 hours before making any non-essential purchase, create a detailed budget before November 1st, use cash instead of credit cards for discretionary spending, unsubscribe from promotional emails, and ask yourself: “Would I buy this at full price?” If the answer is no, walk away. These strategies interrupt the automatic turkey-brained money moves that happen when shopping emotionally.

5. Should I use “buy now, pay later” services for holiday shopping? Generally no. Buy now, pay later services exploit present bias — your brain’s tendency to prioritize immediate pleasure over future consequences. These services make it psychologically easier to overspend because the pain of payment is delayed. If you can’t afford to buy something outright, you probably shouldn’t buy it. These payment plans enable turkey-brained money moves by disconnecting purchase from payment.

6. How do I set boundaries around gift-giving without seeming cheap? Communicate early and clearly. Propose alternatives like Secret Santa (one $50 gift instead of multiple smaller ones), experience gifts instead of physical items, or charitable donations in someone’s name. Most people are relieved when someone suggests scaling back gift-giving — they just don’t want to be the first to say it. Setting boundaries prevents the reciprocity-driven turkey-brained money moves that trap families in expensive gift exchanges.

7. What’s the best way to track holiday spending? Use a dedicated spreadsheet or budgeting app with specific categories: gifts, food, travel, decorations, and miscellaneous. Track every expense in real-time rather than trying to reconstruct spending later. Many people underestimate holiday spending by 30-40% when relying on memory alone. Tracking prevents the awareness gap that allows turkey-brained money moves to accumulate unnoticed.

8. How can I save money on Thanksgiving dinner without looking cheap? Buy generic brands for ingredients guests won’t notice (flour, sugar, butter, spices), shop at discount grocers like Aldi or Costco, make it a potluck where guests contribute dishes, focus premium spending on the hero items (turkey, one signature dessert), and absolutely do not buy the $14 artisanal cranberry sauce when the $2 can tastes identical. Smart hosting avoids the status-signaling turkey-brained money moves that waste money nobody will remember.

9. Is holiday travel worth the cost? That depends entirely on your financial situation and family dynamics. Calculate the true total cost: airfare, rental car, gas, pet boarding, time off work, stress. If that number makes you uncomfortable, consider hosting instead, traveling during off-peak times (fly on Thanksgiving Day itself for 40-60% savings), or alternating years to spread the financial burden. Questioning tradition-based turkey-brained money moves is essential for financial health.

10. How do I recover financially after overspending during the holidays? First, face the damage — review all statements and calculate total overspending. Create a debt paydown plan focusing on highest-interest debt first. Cut discretionary spending in January and February to compensate. Most importantly, start a holiday savings fund immediately — save monthly so next year’s holidays don’t create the same financial crisis. Recovery requires acknowledging turkey-brained money moves honestly and implementing systems to prevent repetition.