Pumping Profits or Refining Your Portfolio Into Dust? The Unvarnished Truth About Valero Stock

Pumping Profits or Refining Your Portfolio Into Dust? The Unvarnished Truth About Valero Stock

Let’s talk about Valero stock (NYSE: VLO), shall we? Because nothing screams “sexy investment opportunity” quite like America’s largest independent petroleum refiner. I know, I know—you were probably hoping for another article about some flashy tech startup that promises to disrupt the disruption of disrupted markets. But stick with me here, because Valero stock might just be the unsexy hero your portfolio desperately needs.

After two decades of watching investors chase shiny objects only to get burned, I’ve learned that sometimes the best opportunities smell like diesel fuel and operate in San Antonio, Texas. So grab your hard hat and safety goggles, folks. We’re diving deep into the refining game.

The Valero Stock Story: More Than Just Gas Stations

First, let’s establish what we’re dealing with. Valero stock represents ownership in Valero Energy Corporation, a company that’s been in the petroleum refining business since 1980. But here’s where it gets interesting: Valero isn’t your grandpa’s oil company sitting on vast underground reserves. Instead, Valero stock gives you exposure to one of the world’s most sophisticated refining operations, processing 3.2 million barrels per day across 15 refineries spanning the United States, Canada, and the United Kingdom.

Think of Valero stock as owning a piece of the infrastructure that transforms crude oil into the gasoline that powers your road trips, the diesel that moves goods across the country, and the jet fuel that gets you to your next vacation. It’s not glamorous, but it’s absolutely essential. And in investing, “essential” often translates to “profitable”—at least when management knows what they’re doing.

The beauty of Valero stock lies in its business model. Unlike integrated oil companies that drill for oil, Valero focuses exclusively on refining. This means Valero stock performance is less about the absolute price of crude oil and more about the “crack spread”—the difference between crude oil costs and refined product prices. When that spread widens, Valero stock tends to smile. When it narrows, well, not so much.

Breaking Down the Valero Stock Numbers

As of late October 2025, Valero stock has been trading around the $171-$175 range, giving the company a market capitalization hovering near $54 billion. That’s substantial enough to matter but not so massive that growth becomes mathematically impossible. The sweet spot, if you will.

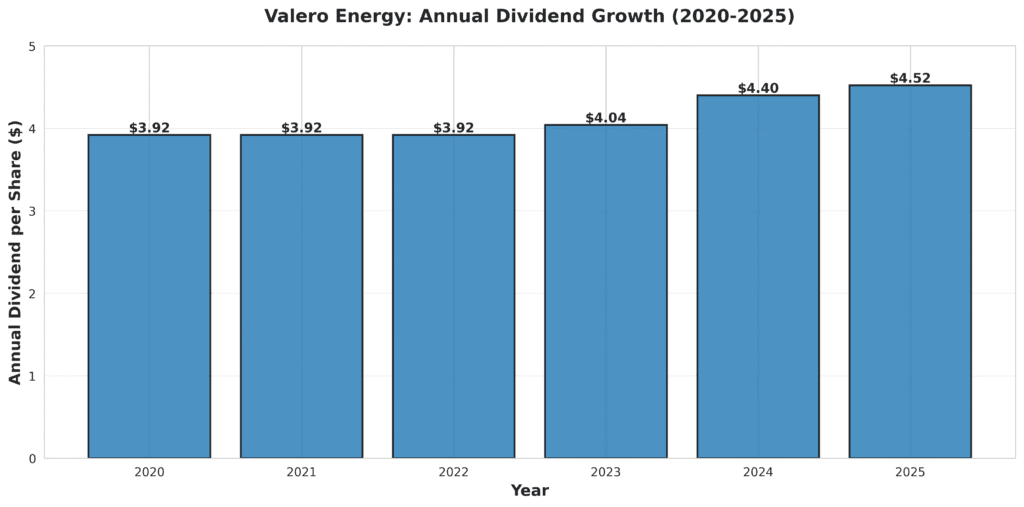

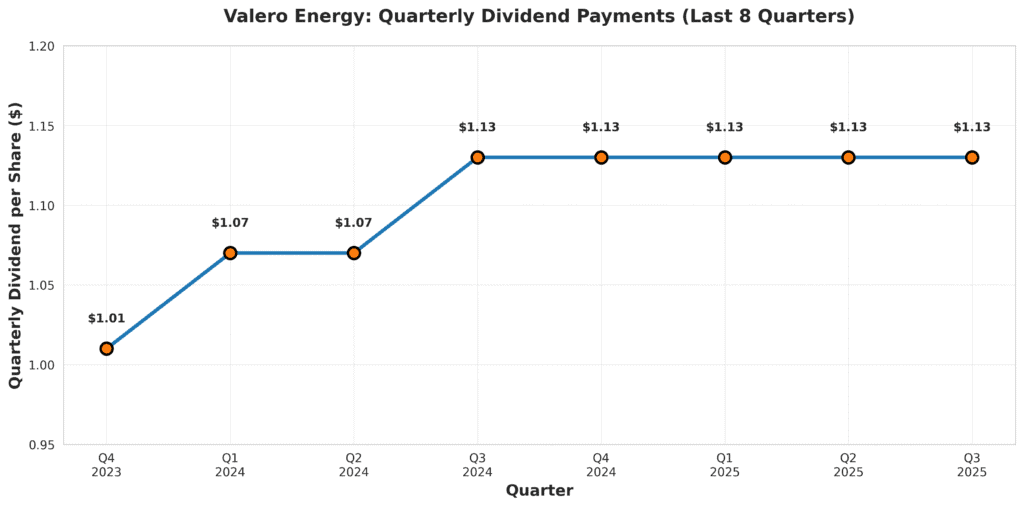

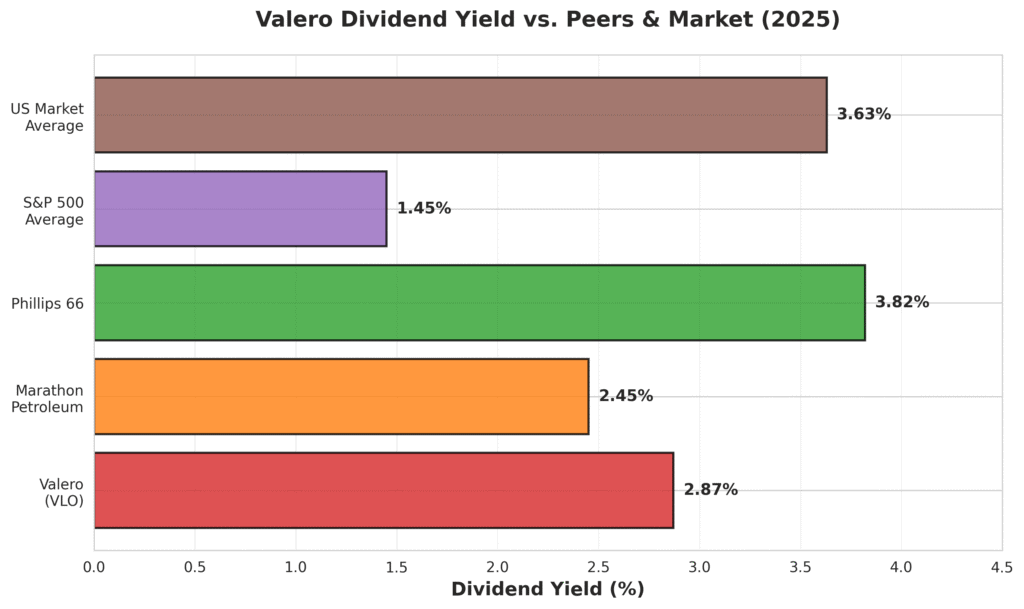

Now, here’s where Valero stock starts looking interesting for income investors: the dividend yield sits at approximately 2.6-2.9%, depending on which day you check and which analyst you trust. Valero pays quarterly dividends of $1.13 per share, which translates to $4.52 annually. Not exactly lighting the world on fire, but in today’s market, you could do a lot worse.

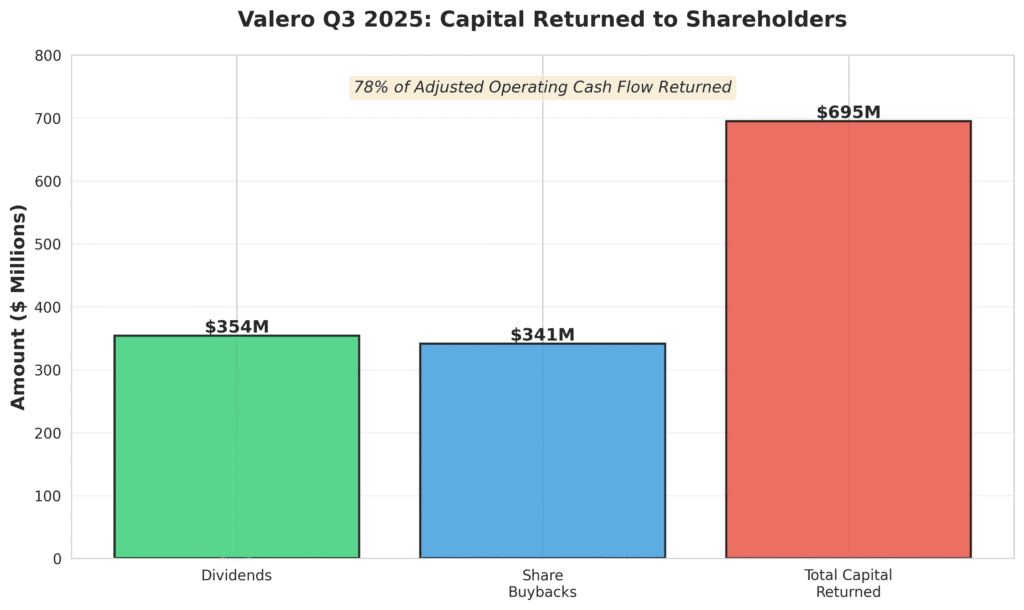

What makes Valero stock particularly compelling from a dividend perspective is the company’s commitment to shareholder returns. In the third quarter of 2025 alone, Valero returned a jaw-dropping 78% of adjusted operating cash flow to shareholders through dividends and stock buybacks. That’s not a company hoarding cash for some pie-in-the-sky acquisition. That’s management saying, “We think you deserve this money more than we do.”

But let’s talk earnings, because that’s where Valero stock really tells its story. The company reported third-quarter 2025 earnings of $3.66 per share, with net income attributable to stockholders hitting $1.1 billion. That represents a massive improvement from $371 million the year before. The earnings beat consensus forecasts, causing shares to jump 7% in a single day.

For the full year 2025, analyst consensus estimates for Valero stock have earnings coming in around $8.83 per share. With the stock trading in the low-$170s, that gives us a forward P/E ratio of roughly 19-20x. Not exactly bargain-basement territory, but not ridiculously expensive either, especially considering the earnings trajectory.

The Bullish Case for Valero Stock

Let me put on my optimist hat for a moment (I promise it won’t last long—two decades of market-watching has made me naturally cynical). There are several legitimate reasons why Valero stock could be a solid investment moving forward.

The Cost Advantage Play: One of the most underappreciated aspects of Valero stock is the company’s structural cost advantages. Valero’s refineries are strategically positioned to access cost-advantaged light crude oil from domestic sources. Even better, many of their facilities can process heavy, sour crude—the stuff that’s cheaper because it’s harder to refine. This gives Valero a competitive moat that’s difficult for competitors to replicate without massive capital investment.

Additionally, Valero stock benefits from lower operating costs thanks to cheap domestic natural gas prices. When you’re running energy-intensive refining operations, your natural gas bill matters. A lot.

The Diversification Beyond Gasoline: Critics love to point out that electric vehicles will destroy gasoline demand and render refiners obsolete. Fair point. But Valero stock isn’t sitting idly by waiting for that future. The company operates 12 ethanol plants with 1.6 billion gallons of annual capacity and holds a 50% stake in Diamond Green Diesel, which can produce 1.2 billion gallons of renewable diesel per year.

Is this enough to completely offset declining gasoline demand? Probably not. But it’s a hedge. And hedges matter when you’re trying to preserve capital over decades.

The Refining Margin Recovery: Here’s the thing about Valero stock that many investors miss—refining margins are cyclical. They compress, then expand, then compress again. Throughout 2024 and early 2025, margins were under pressure. But by the third quarter of 2025, crack spreads were rebounding, and Valero’s earnings reflected that recovery.

When refining margins expand, Valero stock can generate truly impressive cash flows. And in a world where governments aren’t exactly rushing to approve new refinery construction (for environmental reasons, among others), existing refining capacity becomes increasingly valuable.

The Shareholder-Friendly Management: I’ve seen too many management teams talk a big game about “returning value to shareholders” while actually funneling cash into empire-building acquisitions or vanity projects. Valero’s management actually walks the walk. Between dividends and buybacks, they’re aggressively returning capital. For Valero stock investors, that matters enormously.

The Bearish Case Against Valero Stock (Because Reality Exists)

Now let’s put on the skeptic hat, which fits far more comfortably. Valero stock faces some legitimate headwinds that every investor needs to understand before committing capital.

The EV Elephant in the Room: Let’s not dance around this. Electric vehicle adoption is accelerating. As more EVs hit the roads, gasoline demand will inevitably decline. Since gasoline represents a significant portion of what Valero produces, this presents an existential challenge for Valero stock over the long term.

Optimists will argue that this transition will take decades. Pessimists will point to how quickly market share can shift once a tipping point is reached. The truth probably lies somewhere in the middle, but the direction of travel is clear. Valero stock investors need to accept that they’re investing in a business with a potentially finite timeline for its core product.

The Regulatory Risk: Refineries aren’t exactly beloved by environmental regulators or progressive politicians. Valero stock faces ongoing regulatory pressure on emissions, environmental compliance, and increasingly stringent fuel standards. Each new regulation potentially adds costs or requires capital expenditure.

Case in point: In early 2025, Valero announced plans to potentially idle or cease refining operations at its Benicia Refinery in California. That’s not exactly a vote of confidence in the long-term regulatory environment.

The Cyclical Nature of the Business: Here’s the uncomfortable truth about Valero stock—when refining margins compress, earnings can fall off a cliff. First quarter 2025 was brutal, with the company posting a net loss of $595 million. Yes, they bounced back strongly in subsequent quarters, but that volatility is inherent to the business model.

If you’re buying Valero stock, you need to be comfortable with the fact that earnings will be lumpy. Some years will be great. Others will be painful. That’s just how refining works.

The Debt Situation: While Valero maintains a relatively healthy balance sheet with a 19% debt-to-capitalization ratio, the company has been issuing debt. In early 2025, Valero priced $650 million in Senior Notes due 2030 with a 5.150% interest rate. They’re using the proceeds to refinance older, cheaper debt. In a higher interest rate environment, that matters.

How Valero Stock Fits Into Your Portfolio

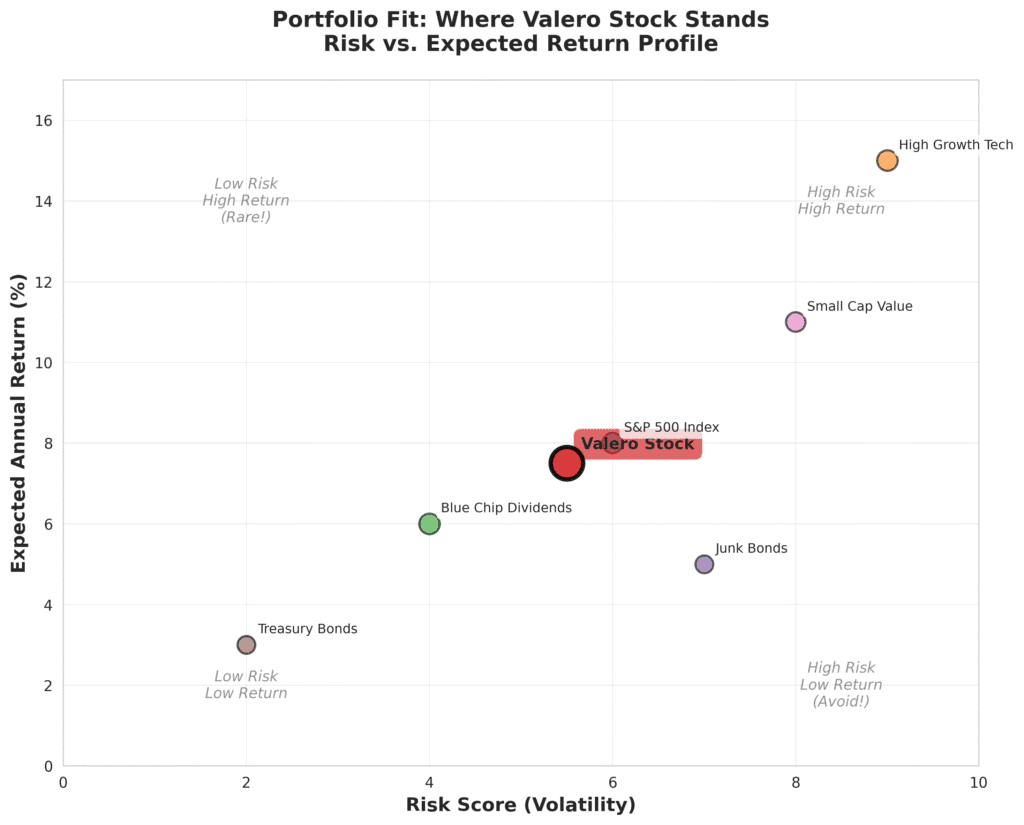

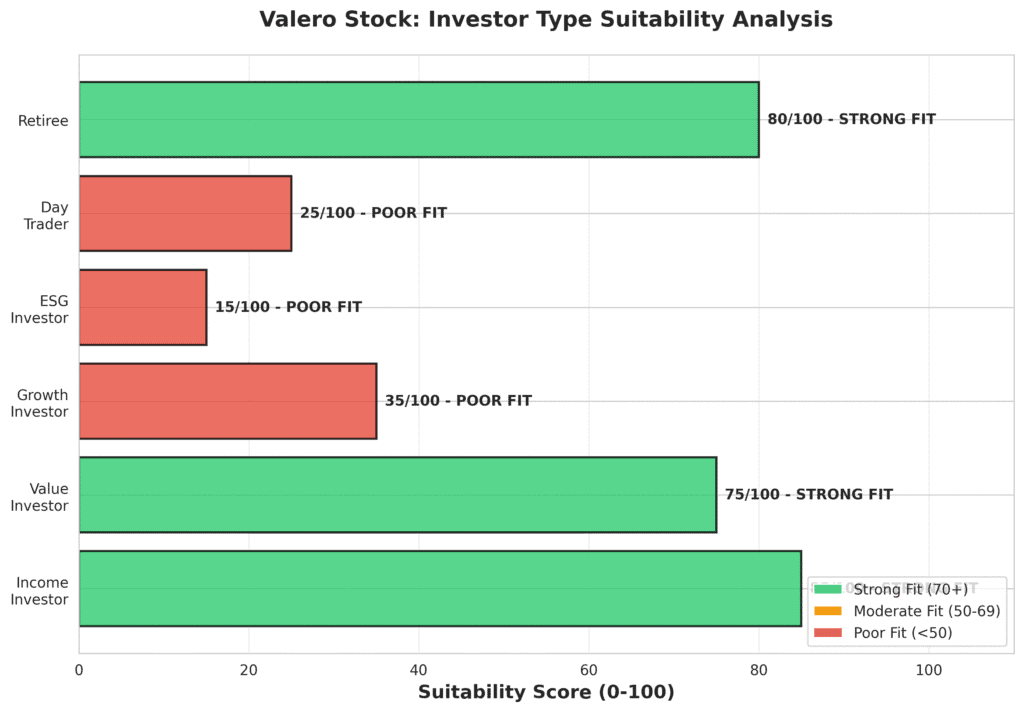

After 20 years of writing about markets, I’ve learned that there’s no such thing as a perfect investment—only investments appropriate for specific situations and risk tolerances. So where does Valero stock fit?

For Income Investors: If you’re building a dividend portfolio, Valero stock offers a respectable 2.6-2.9% yield backed by strong cash generation. It’s not the highest yield in the energy sector, but it’s supported by solid fundamentals and a management team committed to returning capital. The quarterly dividend of $1.13 provides regular income without the sky-high yields that often signal danger.

For Value Investors: With a forward P/E around 19-20x and recent earnings momentum, Valero stock sits in an interesting valuation zone. It’s not screaming bargain, but it’s not wildly overvalued either. Analysts maintain an average “Buy” rating with a 12-month price target around $176, suggesting modest upside from current levels.

For Growth Investors: Let’s be honest—if you’re chasing triple-digit growth, Valero stock isn’t your vehicle. This is a mature, cyclical business in a slowly declining industry. However, if you define growth more broadly to include cash flow generation and shareholder returns rather than just revenue expansion, Valero stock has something to offer.

For ESG-Focused Investors: Here’s where things get awkward. If environmental, social, and governance factors are paramount to your investment decisions, Valero stock probably doesn’t make the cut. Fossil fuel refining simply doesn’t align with most ESG mandates, regardless of how well the company manages its environmental responsibilities or how progressive its renewable diesel initiatives might be.

The Valero Stock Technical Picture

I’m generally skeptical of pure technical analysis—after two decades, I’ve seen too many “can’t miss” chart patterns fail spectacularly. But technicals can provide useful context, so let’s look at where Valero stock stands.

The 52-week range for Valero stock spans from $99 to $178.43. As of late October 2025, shares are trading in the low-$170s, putting them near the upper end of that range. That’s after a strong run from the lows, driven primarily by improving refining margins and better-than-expected earnings.

Recent momentum indicators suggest strength, with Valero stock earning a Momentum Style Score of A from Zacks Investment Research. The stock has gained momentum following its Q3 earnings beat, and shares jumped 1.3% over a recent four-week period.

However—and this is important—Valero stock isn’t far from 52-week highs. If you’re the type who likes buying stocks after they’ve pulled back rather than chasing strength, you might want to wait for a better entry point. Refining stocks are cyclical enough that patience often gets rewarded.

The Competitive Landscape

Valero stock doesn’t operate in a vacuum. The independent refining space includes competitors like Marathon Petroleum, Phillips 66, and PBF Energy. What sets Valero stock apart?

Scale, for one thing. As the largest independent refiner in the United States, Valero enjoys economies of scale that smaller competitors can’t match. That matters when you’re negotiating crude oil purchases or selling refined products.

Geography provides another advantage for Valero stock. The company’s refinery network is diversified across multiple regions, reducing exposure to any single market’s dynamics. That geographic diversity also provides operational flexibility—if margins compress in one region, stronger performance elsewhere can partially offset the pain.

The renewable diesel initiative through Diamond Green Diesel gives Valero stock an edge in the transition to lower-carbon fuels. While this won’t save the company if gasoline demand truly craters, it provides options that some pure-play refiners lack.

What Wall Street Thinks About Valero Stock

Analyst sentiment on Valero stock is generally constructive, though not uniformly bullish. Eighteen analysts covering the stock average a “Buy” rating, with a 12-month price target of $176.71. That represents potential upside of roughly 3.3% from current levels—hardly earth-shattering, but positive nonetheless.

Goldman Sachs reiterated its Buy rating on Valero stock in late October 2025, as did UBS. These aren’t contrarian calls from small boutique shops—they’re mainstream endorsements from major Wall Street players. Whether that makes you more or less confident in Valero stock depends on your view of institutional analyst competence (my view: mixed, at best).

Zacks Investment Research rates Valero stock as a #2 Buy with a VGM Score of A. The firm notes that eight analysts have revised earnings estimates upward in the last 60 days, with the consensus estimate for fiscal 2025 increasing to $8.83 per share.

Importantly, Valero stock boasts an average earnings surprise of 138.8%—meaning the company has consistently beaten analyst expectations. While past performance doesn’t guarantee future results (legally required disclaimer), it does suggest that either management is sandbagger extraordinaire or analysts consistently underestimate the company’s earning power.

The Risk-Reward Calculation for Valero Stock

Let’s get real for a moment. Every investment involves trade-offs between risk and potential reward. With Valero stock, here’s what you’re really buying:

The Good: You get exposure to essential energy infrastructure, strong cash flow generation, shareholder-friendly capital allocation, structural cost advantages, and a management team with a track record of execution. You also get a decent dividend yield backed by solid fundamentals.

The Bad: You accept exposure to commodity price volatility, cyclical earnings, long-term demand headwinds from electric vehicles, regulatory risk, and the reality that you’re investing in a business whose core product faces secular decline.

The Verdict: Valero stock makes sense for investors who understand and accept these trade-offs. If you need dividend income, want exposure to the energy sector, and believe refining margins will remain attractive for the next 5-10 years, Valero stock deserves a spot on your watchlist. If you’re investing with a 20+ year time horizon or prioritize ESG factors, you should probably look elsewhere.

How to Play Valero Stock (If You Decide To)

Assuming you’ve done your homework and decided that Valero stock fits your portfolio objectives, how should you actually implement the position?

Dollar-Cost Averaging: Given the cyclical nature of refining, I’d suggest building a position over time rather than going all-in at once. Valero stock will have good quarters and bad quarters. Buying in increments lets you average different entry points, potentially improving your overall cost basis.

Watch the Crack Spreads: If you’re serious about owning Valero stock, you need to understand crack spreads—the profitability indicator for refiners. When crack spreads widen, Valero stock typically performs well. When they compress, pain follows. Several financial websites track 3-2-1 crack spreads, and monitoring these can help you time your purchases.

Consider the Broader Energy Context: Valero stock doesn’t move in isolation. Pay attention to crude oil prices, product demand, refinery utilization rates, and seasonal patterns. Summer driving season and winter heating demand both affect refined product consumption, which directly impacts Valero’s profitability.

Set Realistic Expectations: This isn’t a get-rich-quick stock. Valero stock is a value play with income characteristics operating in a mature industry. If it compounds at 7-10% annually over the next five years, that would be a successful outcome. Don’t expect Tesla-like returns, because they’re not coming.

The Bottom Line on Valero Stock

After 2,500 words, here’s what it all comes down to: Valero stock is a perfectly reasonable investment for the right type of investor at the right price. It’s not sexy. It’s not going to triple in the next year. It won’t win you any points at cocktail parties when you discuss your portfolio.

But Valero stock represents ownership in a well-managed company with genuine competitive advantages operating in an industry that, while facing long-term challenges, still generates substantial cash flows. For investors seeking income, value, and exposure to energy infrastructure, Valero stock checks many of the right boxes.

The key is going in with eyes wide open. Understand what you’re buying: a cyclical business in a slowly declining industry, managed by a shareholder-friendly team that’s successfully navigating a challenging environment. Accept the volatility, embrace the dividends, and don’t invest money you’ll need in the next 1-2 years (because earnings will be lumpy).

Valero stock won’t make you rich overnight. But it might just help you build wealth over time while providing steady income along the way. And after 20 years of watching investors chase moonshots only to crash and burn, I’ve learned to appreciate investments that do exactly what they promise, year after year, quarter after quarter.

Is Valero stock right for your portfolio? Only you can answer that. But now at least you have the information to make an informed decision rather than following some random tip from your brother-in-law who read something on Reddit.

Do your own research, understand the risks, and invest accordingly. And maybe, just maybe, Valero stock will be one of those boring positions that quietly compounds wealth while everyone else chases the latest meme stock to zero.

Wittier Reads: Because Boring Stocks Deserve Brilliant Analysis

AbbVie (ABBV): Is This Dividend Tank Built to Survive After Humira?

Drug pipelines and dividend streams — AbbVie’s story proves that boring cash flow can still flex.

Market Panic Investing: How Smart Investors Profit When Everyone Else Panics (2025 Edition)

When the market loses its mind, the calmest investor usually cashes the biggest checks. Here’s how to stay sane — and profitable.

7 Best Brokerages for Dividend Investing in 2025 (Witty, Wealthy & Worry-Free)

Because choosing the wrong broker is like paying fees to be broke — pick smart, trade easy, and let your dividends do the heavy lifting.

For more information on Valero Energy Corporation, visit their investor relations website or review recent coverage on Yahoo Finance and Seeking Alpha.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Investing in Valero stock involves risk, including possible loss of principal. Consult with a qualified financial advisor before making investment decisions regarding Air Products stock or any other security.