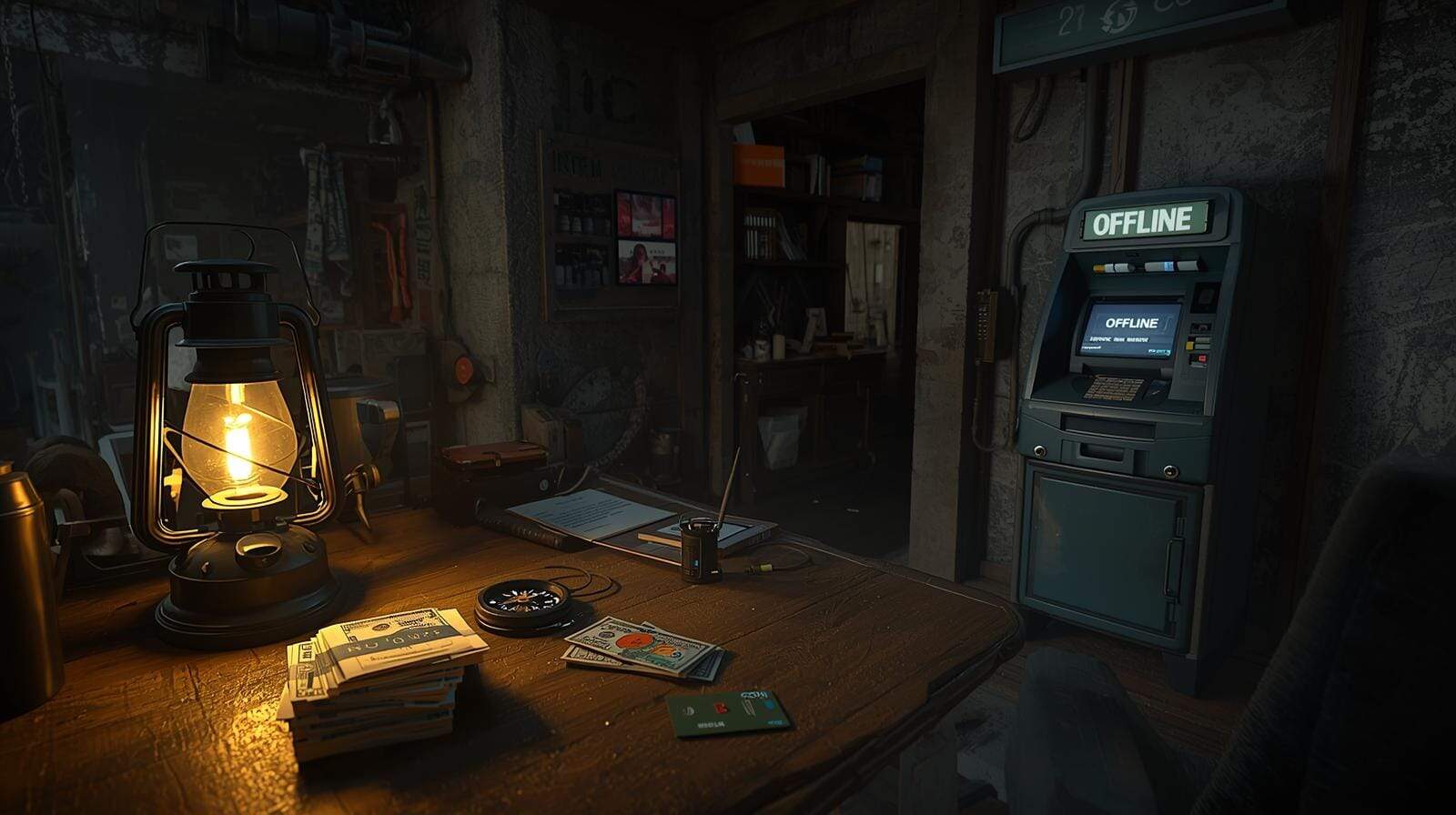

Why Cash Still Matters When Banks Go “Offline”

Why Cash Still Matters When Banks Go “Offline”

Because your debit card is useless when the grid takes a nap.

We live in a world where everyone’s convinced cash is dead — until the moment the internet hiccups, your bank app gives you the digital middle finger, and suddenly you’re standing at the gas pump like a confused NPC holding a useless piece of plastic. Understanding why cash still matters isn’t nostalgia — it’s survival economics.

Banks love telling you, “Everything is fine,” right up until something isn’t. A cyberattack, a power outage, a software update gone horribly wrong, or some brilliant engineer spilling Red Bull on the wrong server — whatever the cause, when banks go “offline,” your money becomes Schrödinger’s cash: it both exists and doesn’t. That’s exactly why cash still matters in 2025, even as the Federal Reserve continues pushing digital payment adoption at record rates.

And that’s where cold, hard cash comes in. Not for hoarding in Scrooge McDuck piles, but as part of a smart, tactical financial preparedness plan that keeps you operational when the digital system glitches. Learning why cash still matters means understanding resilience, redundancy, and refusing to put all your financial eggs in one digital basket.

Let’s break down exactly why cash still matters, how much you actually need, and how to set up a “Financial Go Bag” that keeps you functioning when everyone else is refreshing the banking app like it’s their ex’s Instagram.

What “Offline Banking” Actually Means

Spoiler: it’s more common than you think.

When banks go “offline,” it usually falls into one of three categories — and understanding these scenarios reveals why cash still matters more than your financial advisor will admit.

1. Network Outages

Your bank depends on a web of systems — internet providers, processing networks, data centers, cloud servers, and all the fragile digital spaghetti holding modern finance together. According to the Federal Financial Institutions Examination Council, banks now rely on an average of 15-20 third-party service providers for basic operations. When just one strand snaps? Poof. “Offline.”

The Visa network alone processes over 150 million transactions per day. When it goes down — and it does — you’ll understand why cash still matters in about 3.5 seconds.

2. Cyberattacks

Ransomware, DDoS attacks, credential hacks — pick your flavor. Criminals don’t need ski masks anymore; they just need Wi-Fi. The FBI’s Internet Crime Complaint Center reported over $12.5 billion in cybercrime losses in 2023, with financial institutions as primary targets.

When Colonial Pipeline got ransacked in 2021, gas stations across the Southeast went CASH ONLY for days. That’s why cash still matters — because hackers don’t care about your contactless payment dreams.

3. Grid/Power Failures

No electricity = no terminals, no ATMs, no POS systems, no online anything. Your money is real… you just can’t touch it. The North American Electric Reliability Corporation warns that grid vulnerabilities are increasing, not decreasing. This is exactly why cash still matters when Mother Nature or infrastructure failure decides to humble us all.

4. System “Maintenance” (AKA: Oops.)

Banks call it maintenance. You call it: “Why is my debit card being declined at Taco Bell at 2 p.m. on a Tuesday?”

Offline banking isn’t rare — it’s frequent, unpredictable, and getting worse as the system gets more digitized and more interconnected. Still wondering why cash still matters? Keep reading.

Why Cash Still Matters (Even If You Love Your Credit Card)

Let me count the ways why cash still matters — and I promise this isn’t your grandpa’s “keep it under the mattress” lecture.

1. Cash Works When Electricity Doesn’t

Imagine a long-term power outage. Card readers? Down. ATMs? Down. Bank branches? Dark.

But cash? Cash shows up to work during the apocalypse wearing a smile and carrying a lunchbox.

The Department of Homeland Security identifies financial services as critical infrastructure for exactly this reason. When the grid fails, digital money becomes theoretical. That’s why cash still matters — it’s infrastructure-independent.

2. Cash Has Zero Latency

It doesn’t need:

- Cell towers

- Cloud servers

- Routers

- Satellite links

- Banking authentication

- Verification networks

- A customer service rep in Mumbai

It just… works.

Instant settlement. No middlemen. No “please try again.” No “transaction declined.” Cash is the original offline mode. Every merchant accepting cards pays 2-4% in processing fees to companies like Visa, Mastercard, and payment processors. That’s why cash still matters to small businesses during tight margins — and why they’ll love you for using it.

3. Cash Keeps You Anonymous

You’re not buying anything illegal — you just don’t need every purchase permanently stamped into the blockchain of data brokers, marketers, and “financial institutions for your safety.”

According to privacy advocates at the Electronic Frontier Foundation, financial surveillance has become normalized. Sometimes you just want a cheeseburger without it becoming part of your credit score personality profile. That’s why cash still matters for financial privacy in an era of total surveillance capitalism.

4. Cash Helps You Barter

During outages, disasters, and supply-chain hiccups, cash is often treated as a barter tool. A $20 bill can get you:

- Gas

- Food

- Firewood

- Help

- Access

— even when digital payments collapse.

The Federal Emergency Management Agency (FEMA) specifically recommends keeping cash in emergency kits. They understand why cash still matters when systems fail. You should too.

5. Cash Builds Bargaining Power

When systems fail, people value simplicity. “Cash price” deals suddenly return like it’s 1994. You’ll see:

- “Cash only today” signs

- Vendors rounding prices

- Discounts for handed-over bills

Cards are convenient. Cash is strategic. That’s why cash still matters — it gives you negotiating leverage when everyone else is frantically trying to Venmo their way through a crisis.

6. Cash Protects Against Bank Runs

Here’s the uncomfortable truth the financial system doesn’t advertise: banks operate on fractional reserve. According to FDIC data, banks only keep about 3-10% of deposits as actual cash. The rest? Loaned out, invested, leveraged.

When customers panic — like during the 2023 Silicon Valley Bank collapse — and everyone tries withdrawing simultaneously, banks freeze accounts, limit withdrawals, and impose “capital controls.” This is why cash still matters as a hedge against systemic banking fragility. Physical currency already in your possession can’t be frozen, seized, or “temporarily restricted for your safety.”

How Much Cash Should You Actually Have?

Let’s keep it tactical — and not “burying money in the backyard under a suspiciously shaped mound” tactical. Understanding why cash still matters is meaningless without an actionable plan.

✅ Tier 1: Everyday Carry Cash ($40–$100)

Small bills only. This covers:

- Gas (12-15 gallons at current prices)

- Food (2-3 meals)

- Emergency Uber ($30-40 ride)

- Random “card reader is down” moments

I carry $60 in my wallet at all times: two $20s, three $5s, and five $1s. It’s saved my bacon at least monthly when technology fails. That’s why cash still matters for daily resilience.

✅ Tier 2: Home Emergency Cash ($300–$600)

This is your “power outage + bank app meltdown + ATMs offline” stash. Financial experts at NerdWallet recommend keeping at least one week’s worth of essential expenses in cash at home.

Store in:

- A small safe (I use a SentrySafe fireproof box)

- A fireproof document bag

- A hidden but accessible location

Not in the freezer. Yes, people do this. No, it’s not smart when you need it during a power outage and it’s frozen into a brick. This is why cash still matters — but only if you can actually access it when needed.

✅ Tier 3: Extended Crisis Cash ($1,000–$3,000)

This isn’t paranoia — it’s preparedness. The Consumer Financial Protection Bureau found that 40% of Americans couldn’t cover a $400 emergency expense without borrowing. Having physical cash changes that equation.

Covers:

- Temporary relocation (hotel for 3-5 days)

- Gas for multiple vehicles (full tanks × 2-3)

- Food for several days (for a family of 4)

- Medical or vehicle emergencies

- Critical supplies during supply chain disruptions

And again: small bills. Nobody is breaking a $100 when the grid’s down unless they want to start a fistfight. This tier demonstrates why cash still matters for multi-day crisis scenarios when ATMs run dry and banks stay shuttered.

What Denominations You Actually Need

Banks love big bills. In a crisis, nobody else does. Here’s why cash still matters more when it’s in the right denominations:

✅ $5s — Perfect for small purchases, tips, tolls

✅ $10s — Sweet spot for gas, food, supplies

✅ $20s — Largest bill most places will accept without suspicion

✅ A few $1s — Vending machines, exact change, proving you have “small bills”

🚫 $50s and $100s — These might as well be Monopoly money when change is impossible

Pro tip from 20+ years of preparedness experience: when you withdraw cash, specifically ask the teller for small denominations. They’ll look at you weird. Do it anyway. That’s why cash still matters — but only if it’s actually usable.

Where to Store Your Cash (Without Being an NPC About It)

Understanding why cash still matters means nothing if you store it stupidly.

✅ Fireproof Safe

The gold standard: keeps money secure, protected, and accessible. Look for models rated for at least 1-hour fire protection at 1700°F. The Underwriters Laboratories (UL) rating system provides standards for fire resistance.

✅ Hidden Spots

Not under the mattress — everyone’s first guess, including burglars. Try:

- Inside a hollowed-out book (preferably something boring like “Understanding Tax Code 2019”)

- Behind a vent cover (secured, not just loose)

- Inside a sealed, labeled “old cables” box (thieves hate boring boxes)

- In a false-bottom drawer

- Inside an old coffee can in the garage workshop (labeled “rusty screws”)

Diversify hiding spots. This is why cash still matters as a backup system — redundancy prevents single points of failure.

✅ Car Stash ($20–$50)

Inside your vehicle emergency kit. Hidden. Not in the cup holder like a Disney dad. I keep mine in a mylar bag tucked inside the spare tire well, sealed against moisture.

Your car breaks down in the middle of nowhere, your phone’s dead, and the only tow truck that shows up is run by a guy who “don’t take cards.” This is why cash still matters for mobile emergencies.

✅ Everyday Carry Wallet

At least a $20 bill for when life does its life-ing. I’ve bought gas from farmers, paid cash-only food trucks, and tipped in emergencies dozens of times. That’s why cash still matters even during “normal” operations — technology fails way more often than we admit.

The “Financial Go Bag” for When Banks Go Offline

This is where financial preparedness gets fun. Build a mini-kit that includes:

✅ Cash (small bills, $300-500 minimum)

✅ A second debit card from a different bank (banking system redundancy)

✅ A backup credit card (different network: if you have Visa, get a Mastercard)

✅ Copies of IDs (laminated or in waterproof sleeve)

✅ Written list of important numbers (since your phone battery will betray you)

✅ Prepaid gas card ($50-100 preloaded)

✅ Prepaid Visa card (reloadable, acts as backup “debit card”)

✅ USB drive with encrypted financial documents (account numbers, contact info)

✅ Checkbook (yes, actually — some places still accept checks when cards fail)

This isn’t just smart — it’s unstoppable. And it perfectly illustrates why cash still matters as part of a diversified financial preparedness strategy, not the only strategy.

Real-World Examples of Offline Banking Problems

These aren’t hypotheticals. These actually happened. And they prove why cash still matters in real-world scenarios:

1. 2023 Rogers Telecom Outage (Canada)

Half the country lost:

- ATMs

- Payment networks

- Banking apps

- Phone service

- Emergency 911 service

Stores went cash-only for days. The Canadian government investigation found critical infrastructure vulnerabilities. Canadians who understood why cash still matters ate. Everyone else… didn’t.

2. 2018 Visa Outage (Europe)

Millions couldn’t pay for:

- Food

- Transportation

- Travel

- Hotels

- Emergency services

The BBC reported chaos across the UK and Europe for over 10 hours. Cash saved people from sleeping on the sidewalk. That’s why cash still matters during systemic payment network failures.

3. 2024 U.S. Regional Bank Outages

“Scheduled maintenance” turned into:

- Frozen direct deposits

- Card declines at grocery stores

- ATM failures across multiple states

- Hours-long lines at branches

The Office of the Comptroller of the Currency tracks these incidents. They’re becoming more frequent, not less. Having cash wasn’t “old school.” It was essential. This is why cash still matters in 2025’s increasingly fragile financial infrastructure.

4. Hurricane Scenarios (Every. Single. Time.)

After every major hurricane — Katrina, Harvey, Maria, Ian — the same pattern emerges: power dies, ATMs go dark, card readers fail, and suddenly cash is the only accepted currency. FEMA after-action reports consistently show cash-holders recovered faster. That’s why cash still matters during natural disasters.

Key Considerations

✅ Don’t Flash Your Cash

If you need $40, don’t pull out a wad the size of a deli sandwich. Situational awareness matters. Understanding why cash still matters includes understanding OPSEC (operational security).

✅ Don’t Keep All Cash in One Place

Diversify like a prepper — not like someone who hides everything in a single sock. I keep cash in:

- My wallet (daily carry)

- Home safe (emergency tier 2)

- Vehicle (mobile backup)

- Go-bag (evacuation ready)

This is why cash still matters and why distribution matters equally.

✅ Rotate Old Bills

Every 3-6 months, swap cash in and out so it doesn’t get musty, mildewed, or forgotten. Spend old bills on groceries and replace them with fresh withdrawals. This is why cash still matters as a living system, not a static hoard.

✅ Don’t Overdo It

You don’t need $20,000(not a problem for me) hidden behind your dryer. You need practical, not paranoid. Understanding why cash still matters means right-sizing for realistic scenarios, not Hollywood fantasies.

✅ Protect Against Inflation

Cash loses purchasing power over time — about 3-4% annually to inflation according to Bureau of Labor Statistics data. That’s why your emergency cash should be supplemented by other stores of value (precious metals, supplies, skills) but never eliminated. This is why cash still matters for immediate liquidity, even if it’s not ideal for long-term storage.

Going Further: Alternatives to Cash

Cash is king during bank outages, but it’s not alone in the kingdom. Understanding why cash still matters doesn’t mean ignoring complementary strategies:

✅ Prepaid cards — Reloadable, work when bank accounts are frozen

✅ Decentralized payment apps (like Bitcoin Lightning for those with technical skills)

✅ Precious metals — Silver coins for long-term stability, not daily buying (US Mint silver eagles are recognizable)

✅ Barter items — Cigarettes, alcohol, batteries, coffee become currency fast during extended crises

This isn’t about becoming the Dollar Store version of John Wick. It’s about having options. That’s why cash still matters — it’s option number one, with backups for options 2-10.

Wrapping Up & My Experience

Look — I’m not anti-tech. I love a good banking app. But after living through enough outages, snowstorms, power failures, and “maintenance windows,” I’ve learned something simple:

Cash is the ultimate backup system.

Over my 25+ years in both finance and preparedness circles, I’ve watched patterns repeat:

- 2003 Northeast Blackout: Cash-holders ate, card-users went hungry

- 2017 Equifax breach: Banks froze accounts, cash kept people moving

- 2021 Texas freeze: No power = no digital payments for a week

- 2023 bank failures: Withdrawal limits appeared overnight

I’ve watched entire grocery stores switch to CASH ONLY because one router died. I’ve seen ATMs freeze while people panicked. I’ve watched banks shrug and say, “We’re working on it.”

Cash is your buffer. Cash keeps you moving. Cash is boring — until the moment it becomes priceless.

This is why cash still matters. This is why cash still matters to me personally. And this is why cash still matters to anyone serious about financial preparedness in an increasingly digital — and increasingly fragile — financial system.

The Federal Reserve can push CBDC (Central Bank Digital Currencies). Big tech can promote contactless everything. Banks can close branches and remove ATMs.

But physics doesn’t change: when the power dies, when networks fail, when systems collapse — cash still matters.

Prepare now. Operate smoothly later. That’s financial preparedness. That’s The Witty Investor.