The Investor Who Bought the Top (And Why You Will Too)

Let’s talk about the rare, mystical, highly-endangered creature known as the investor who bought the top.

Yes, the same guy who swore he’d “wait for a dip,” then panic-clicked “BUY” somewhere between an influencer’s breathless YouTube video and the stock hitting an all-time high so bright it could be seen from space.

And before you smirk: You’ve done it. I’ve done it. Warren Buffett has probably done it — but he had the good sense not to tweet about it.

So let’s break down why investors buy the top with the same enthusiasm as a caffeine-fueled day trader on their third energy drink, and why you’re almost certainly going to do it again the next time Nvidia or Tesla blinks.

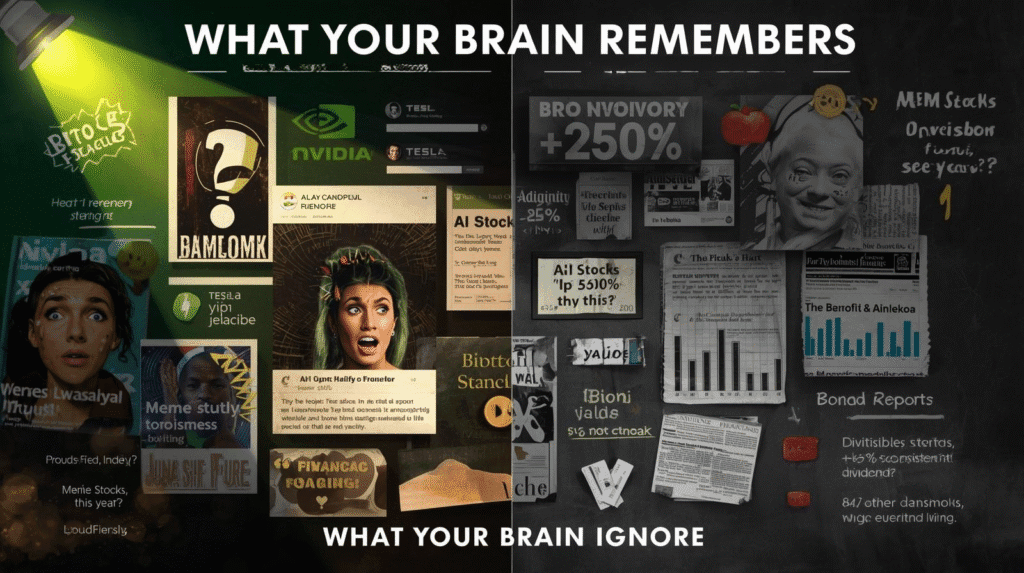

The Psychological Setup: Your Brain Is Not Your Friend

Behavioral finance 101: your brain is a drama queen. It was built for outrunning predators, not interpreting market structure.

So when a stock rips 40% in a week, your brain doesn’t calmly say:

“Fascinating. Perhaps I’ll conduct a fundamental valuation analysis incorporating price-to-earnings ratios, free cash flow projections, and competitive moat assessment.”

No. Your brain screams:

“WE’RE ALL GONNA BE RICH! HIT THE BUTTON BEFORE THE MAGIC ENDS!”

This is the reward-seeking circuitry firing like a toddler discovering sugar. The dopamine spike? Massive. Your rational decision-making? Missing in action, somewhere face-down in a ditch next to your abandoned investment thesis.

Understanding why investors buy the top requires recognizing that our neural pathways were optimized for immediate survival threats—not delayed gratification and compound returns. When you see parabolic price action, your amygdala lights up like a Christmas tree, hijacking the prefrontal cortex that’s supposed to keep you rational.

The neuroscience of financial decision-making shows that anticipating rewards activates the same brain regions as cocaine. Not “similar to.” The same. You’re basically getting high on chart patterns.

If you want a deeper dive into why your brain sabotages your net worth, check out:

Why Most People Suck at Money: The 7 Psychological Sins of Investing

Confirmation Bias: The Devil on Your Shoulder

Once you get the idea in your head that “this stock only goes up,” your brain immediately runs around the internet cherry-picking anything that proves you right.

This selective information processing explains exactly why investors buy the top with such predictable regularity. Your cognitive filters become so fine-tuned to bullish signals that bearish information literally doesn’t register in your conscious awareness.

Not sure if it’s a good buy? No problem — your mind will instantly filter out every bearish detail and deliver you:

- a Reddit guy named “CryptoLORD69” predicting a 10x with an “analysis” consisting of rocket emojis

- a YouTube thumbnail with flames and a shocked face

- an analyst you’ve never heard of saying “STRONG BUY” (probably from a firm with a banking relationship to the company)

- a TikTok bro in a Lululemon hoodie screaming about “parabolic energy”

- and conveniently ignoring the P/E ratio that would make even 1999 blush

Confirmation bias in financial markets isn’t just about seeing what you want to see—it’s about your brain actively suppressing contradictory information to maintain psychological consistency. The technical term is “cognitive dissonance reduction,” but I prefer “expensive self-deception.”

This is why investors buy the top: they’ve constructed an airtight mental fortress where only bullish information is allowed entry, and anything suggesting caution is immediately dismissed as “FUD from bears who missed the rally.”

Recency Bias: Your Memory Is a Liar

Here’s another reason why investors buy the top: recency bias makes recent events feel more important than long-term patterns.

Had a stock go up for six weeks straight? Your brain: “This is the new normal. Physics no longer applies to this ticker.”

Had a stock trade sideways for three years before that? Your brain: “Ancient history. Irrelevant. Probably didn’t even happen.”

Recency bias is why investors buy the top after watching three green weeks, completely forgetting that the same stock spent 18 months going absolutely nowhere before that. Your brain weighs recent data approximately 847 times more heavily than it should, creating a distorted probability assessment that would fail any Statistics 101 exam.

Market cycles average 4-7 years, but most investors can’t remember what they had for breakfast Tuesday, let alone what valuations looked like in the previous correction.

If I had a dollar for every time that my brain did this or something similar. Well, I would not be writing blog posts for you guys. I would probably be on the proverbial island in the south Pacific sipping Pina Coladas on the beach!

Herd Mentality: Follow the Crowd (Straight Off the Cliff)

Even if you were a disciplined investor 10 minutes ago, one look at a surging chart instantly converts you into a stampeding buffalo wearing Nike Dunks.

Humans are social animals. We hate missing out. We fear being the only idiot not doing the thing everyone else is doing.

Understanding why investors buy the top requires acknowledging our evolutionary wiring for social proof. When early humans saw everyone running in one direction, the smart move was to run too—ask questions later. The problem is that “saber-toothed tiger” has been replaced by “meme stock with unsustainable fundamentals.”

So when the herd runs toward the market top? You sprint with them — even though the herd has historically been responsible for:

- tulip mania (1637)

- the South Sea Bubble (1720)

- railway mania (1840s)

- the Roaring ’20s crash (1929)

- the Nifty Fifty stocks (1970s)

- Japanese real estate bubble (1980s)

- housing bubbles (2008)

- Beanie Babies (still hurts)

- whatever crypto project promised 900% APY and collapsed in 44 hours

- and every subsequent “this time is different” delusion throughout history

Research from Yale economist Robert Shiller demonstrates that herd behavior intensifies near market peaks as social reinforcement overwhelms individual analysis. This is why investors buy the top en masse—nobody wants to be left behind when their brother-in-law is bragging about 200% gains at Thanksgiving.

Want to see herd mentality from a survivalist perspective? See:

Prepper Stocks 2025: Profit from the Survival Industry Before It Goes Full Mad Max

Overconfidence: You’re Not the Exception

Every bull market produces two things:

- Overpriced stocks

- Investors who believe they’re market-timing prodigies because one trade went well

Confidence is great. Overconfidence, however, is how you end up buying Nvidia at the exact millisecond it peaks, then spending the next 3 months staring at it like it personally betrayed your family.

This explains precisely why investors buy the top: skill and luck become indistinguishable during bull markets. You make money, therefore you must be smart. The market goes up, you buy, the market goes up more—clearly you’re a genius. Then the music stops, and you realize correlation isn’t causation.

Your internal monologue goes like this:

“I know it’s overvalued, but I understand this market better than the permabears. I’ve done my research. This company is different. They’re disrupting seventeen industries simultaneously. P/E ratios don’t matter anymore because [insert buzzword salad here].”

Buddy… if understanding the market actually worked, there wouldn’t be any markets left. Just billionaires driving Lamborghinis into the ocean for tax purposes.

Studies show that men are particularly susceptible to overconfidence bias, with male investors trading 45% more frequently than women and earning 2.65% less annual returns as a result. Why do investors buy the top? Often because testosterone and overconfidence make a truly spectacular combination for wealth destruction.

Anchoring Bias: The Price You Can’t Forget

Here’s another psychological trap that explains why investors buy the top: anchoring to arbitrary price levels.

Saw a stock at $150 last month? Now it’s $180? “It’s expensive.”

But wait—it hit $200 last week and pulled back to $180? “It’s a bargain! Buy the dip!”

Same price. Same fundamentals. Different perception entirely.

This is also my conspiracy theory on Black Friday “deals”. Its the same sort of idea, if you ask me.

Anchoring bias causes why investors buy the top because they’re comparing current prices to recent highs rather than intrinsic value. You’re not asking “what is this worth?”—you’re asking “is this cheaper than last Tuesday?”

This is like deciding a $50,000 car is a great deal because it was $52,000 yesterday, without ever considering whether the car is worth $30,000.

FOMO: The Siren Song of Stupidity

FOMO is the most powerful psychological force in investing, and it’s the clearest answer to why investors buy the top.

FOMO can:

- override your risk tolerance

- override your logic

- override your investment policy statement

- override the fact that you literally swore last Thursday you’d stop chasing charts

- override math, reason, and occasionally physics

And when FOMO hits, you don’t buy slowly and rationally with dollar-cost averaging and position sizing— you buy all at once, at the exact wrong moment, because your brain promises:

“If you don’t buy right now, you’ll die poor and alone, and everyone at the office holiday party will pity you while discussing their yacht purchases.”

This, by the way, is the same brain that forgets where it put your keys and once convinced you that 2 a.m. gas station sushi was a good idea.

FOMO transforms rational investors into momentum chasers faster than you can say “parabolic blow-off top.” It’s why investors buy the top even when every technical indicator is flashing “overbought” and the RSI has achieved numbers previously thought impossible.

The fear of missing out isn’t really about missing gains—it’s about missing the social validation that comes from being part of the winning tribe. Nobody talks about their bonds at parties.

The Availability Heuristic: Recent Winners Dominate Your Thinking

Another key reason why investors buy the top: the availability heuristic makes you think whatever’s easiest to remember must be most important.

Which stocks come to mind instantly? The ones making headlines. The ones up 300% this year. The ones your cousin won’t shut up about.

Meanwhile, boring companies with reasonable valuations and consistent cash flows? Completely invisible. They’re not available to your memory, so your brain treats them as non-existent.

This is why investors buy the top of glamour stocks while ignoring value opportunities—the flashy stuff dominates mental availability, creating a distorted perception of where opportunities actually exist.

Loss Aversion (In Reverse): The Pain of Missing Out

Traditional loss aversion says people fear losses more than they value equivalent gains. But here’s the twist that explains why investors buy the top: during euphoric markets, loss aversion flips.

You stop fearing capital loss. You start fearing opportunity loss.

Missing the next 50% move feels more painful than the risk of a 30% drawdown, so you jump in with both feet at precisely the moment when risk is highest and expected returns are lowest.

This inverted loss aversion is why investors buy the top despite knowing intellectually that “buy low, sell high” is the goal. The emotional pain of being left out overwhelms the intellectual understanding of valuation principles.

Why You Will Do This Again (Yes, You.)

Because no matter how much experience you gain, how many charts you study, how many losses scar your soul, or how many articles about why investors buy the top you read while swearing “never again”…

Your brain still hates uncertainty more than anything.

Buying the top feels safe because the trend is strong. It feels validated because everyone else is doing it. It feels urgent because the candles are green. It feels obvious because the narrative is compelling.

And your brain chases feelings harder than fundamentals.

This is the paradox: why do investors buy the top when they know they shouldn’t? Because buying feels less risky than waiting when momentum is strong. Your brain interprets falling prices as risk and rising prices as safety, exactly backwards from how valuation actually works.

Unless you build systems—actual rules, boundaries, and processes—you will always be at the mercy of your emotions. You need:

- Predetermined position sizing rules

- Valuation thresholds that trigger sells

- Automatic rebalancing schedules

- Diversification requirements you can’t override

- A cooling-off period between “I want to buy” and actually buying

- Someone (or something) to tell you “no” when you’re about to do something stupid

If you need a place to start, you might like:

6 Dividend ETFs That Pay You to Stay Put in 2025

The Moral of the Story

Buying the top doesn’t make you stupid. It makes you human.

But understanding why investors buy the top—and continuing to do it anyway? That’s optional.

Every time you ask yourself “why do investors buy the top?”, remember: it’s not an intelligence problem. It’s a wiring problem. Your brain is running software designed for the African savannah, not the New York Stock Exchange.

If you want to stop repeatedly donating money to the market, start understanding your psychology, build guardrails, set rules, and stop treating every green candle like divine prophecy sent specifically to make you wealthy.

Because the truth is simple:

The investor who buys the top isn’t a villain. He’s not even particularly dumb. He’s just the main character in a behavioral finance comedy that never ends…

And yes—he’ll absolutely do it again.

Unless he recognizes why investors buy the top, accepts that he’s vulnerable to the same psychological forces as everyone else, and builds systems that protect him from his worst instincts.

The question isn’t whether you’ll be tempted to buy the next top. You will be.

The question is whether you’ll have the systems in place to stop yourself.

FAQ: Why Investors Buy the Top

Q: What does “buying the top” mean in investing?

A: Buying the top means purchasing a stock, fund, or asset at or near its peak price—right before it declines. It’s that special moment when you finally convince yourself to jump in, only to watch your investment immediately drop faster than your confidence. Essentially, you’ve paid the maximum price possible, which is the financial equivalent of buying an umbrella after the storm has passed.

Q: Why do investors consistently buy the top if they know it’s a bad idea?

A: Because knowing something intellectually and acting on it emotionally are two completely different things. Why investors buy the top comes down to hardwired psychological biases: FOMO, herd mentality, recency bias, and confirmation bias all conspire to make buying at peaks feel safe and urgent. Your brain interprets rising prices as reduced risk (when the opposite is true) and falling prices as increased risk. It’s backwards, but it’s also completely human.

Q: How can I tell if a stock is at the top before I buy it?

A: You can’t—not with certainty. That’s the frustrating answer. However, you can look for warning signs: extreme P/E ratios compared to historical averages, parabolic price movements, excessive media hype, everyone from your barber to your Uber driver talking about it, and RSI indicators above 70. If buying the stock feels urgent and everyone agrees it’s a “can’t lose” opportunity, you’re probably closer to a top than a bottom. When investing feels easy and obvious, danger is usually nearby.

Q: What psychological bias is most responsible for buying the top?

A: It’s not just one—it’s a toxic cocktail. FOMO (fear of missing out) is probably the primary driver, creating urgency and panic. But herd mentality makes you follow the crowd, confirmation bias helps you ignore warning signs, recency bias makes recent gains feel permanent, and overconfidence convinces you that “this time is different.” Understanding why investors buy the top requires recognizing that these biases don’t operate independently—they reinforce each other, creating a psychological perfect storm that overwhelms rational analysis.

Q: What should I do if I’ve already bought the top?

A: First, don’t panic-sell at the bottom and complete the classic “buy high, sell low” disaster cycle. Assess whether your investment thesis is still valid or if you bought based purely on momentum and emotion. If the company fundamentals are solid and you have a long time horizon, holding through drawdowns often makes sense. If you bought garbage because everyone else was doing it, cutting losses might be appropriate. Most importantly, study what psychological factors led you to buy at that moment, write them down, and use the experience to build better systems. Expensive lessons are only valuable if you actually learn from them.